2024: The Year of Monetization for Spotify – Europe at the forefront.

As Spotify pushes to profitability, price rises remain a key growth driver as Q1 highlights weakest QoQ subscriber adds in two years.

The ‘year of monetization’ is what Spotify’s CEO referenced in its 1Q24 results, as it continues to push towards profitability. Consumer price rises will remain a key driver of growth as Q1 highlighted the weakest quarter-on-quarter net Premium subscriber additions seen in two years.

Europe is a key market for Spotify.

European Spotify subscribers represent c.38% of its Premium subscriber base. However, we also know that subscribers in Europe are paying much more for their subscriptions each month than anywhere else in the world.

For context, subscribers in the UK can pay from £5.99 for a Student Plan to £19.99 per month for a Family Plan (with other plan options in between). In Germany and Italy it’s €5.99 – €17.99 per month, while in France current pricing is the same but is expected to lift again in light of a new tax directed at music-streaming services. All this compared with $5.99 – $16.99 in the US and near to 50% less across many countries in Asia and Latin America.

Price rises with minimal impact so far

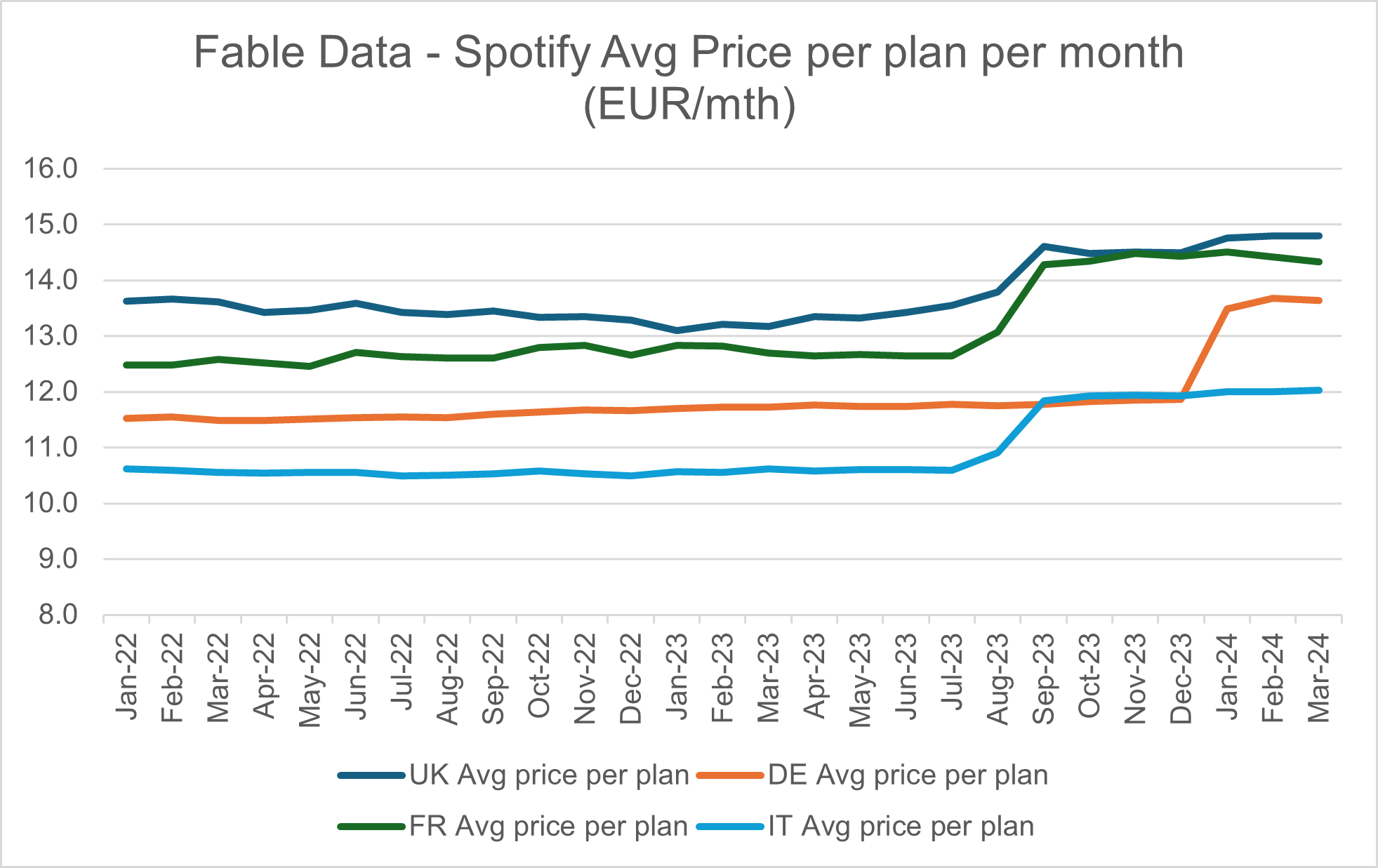

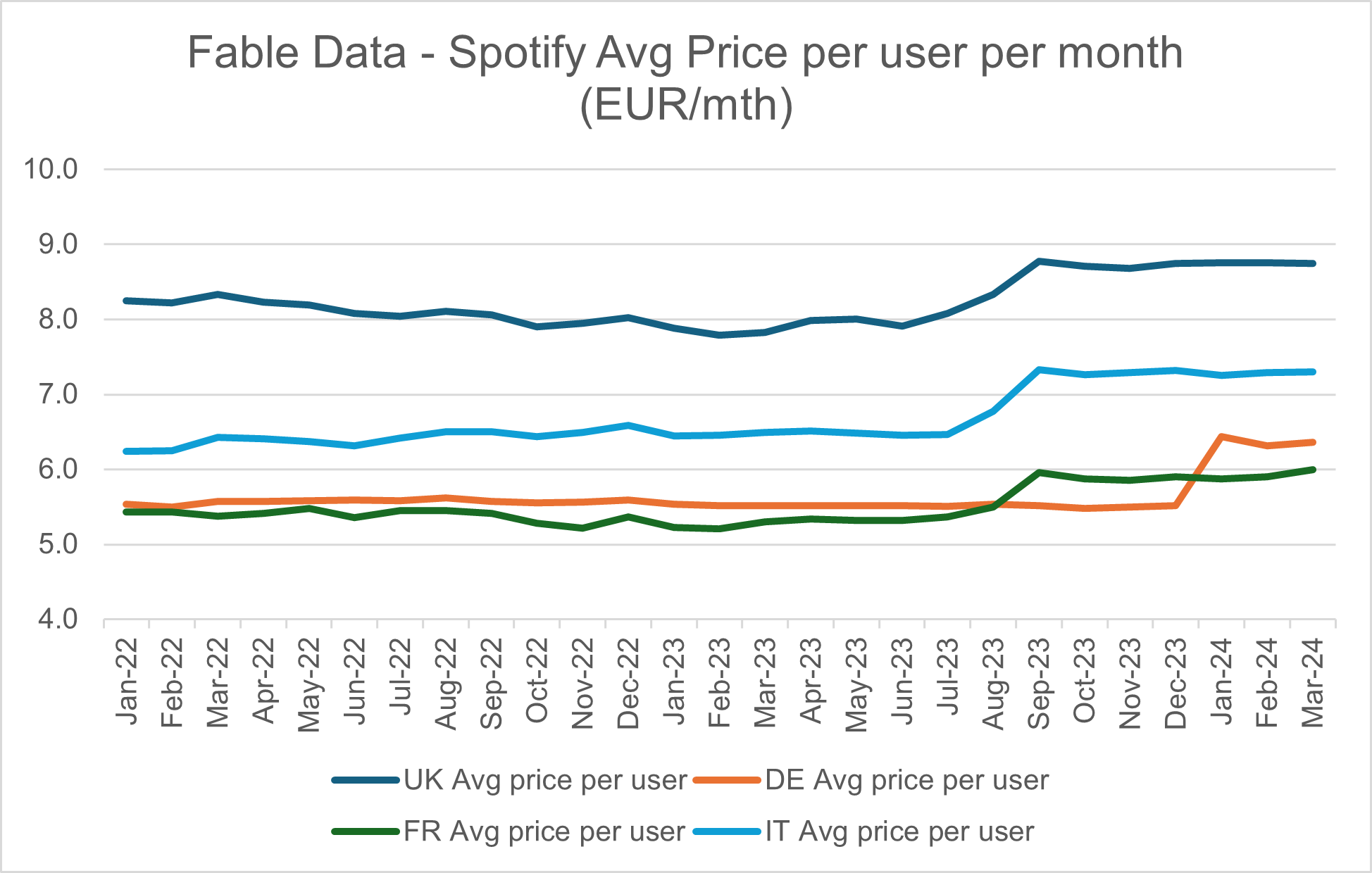

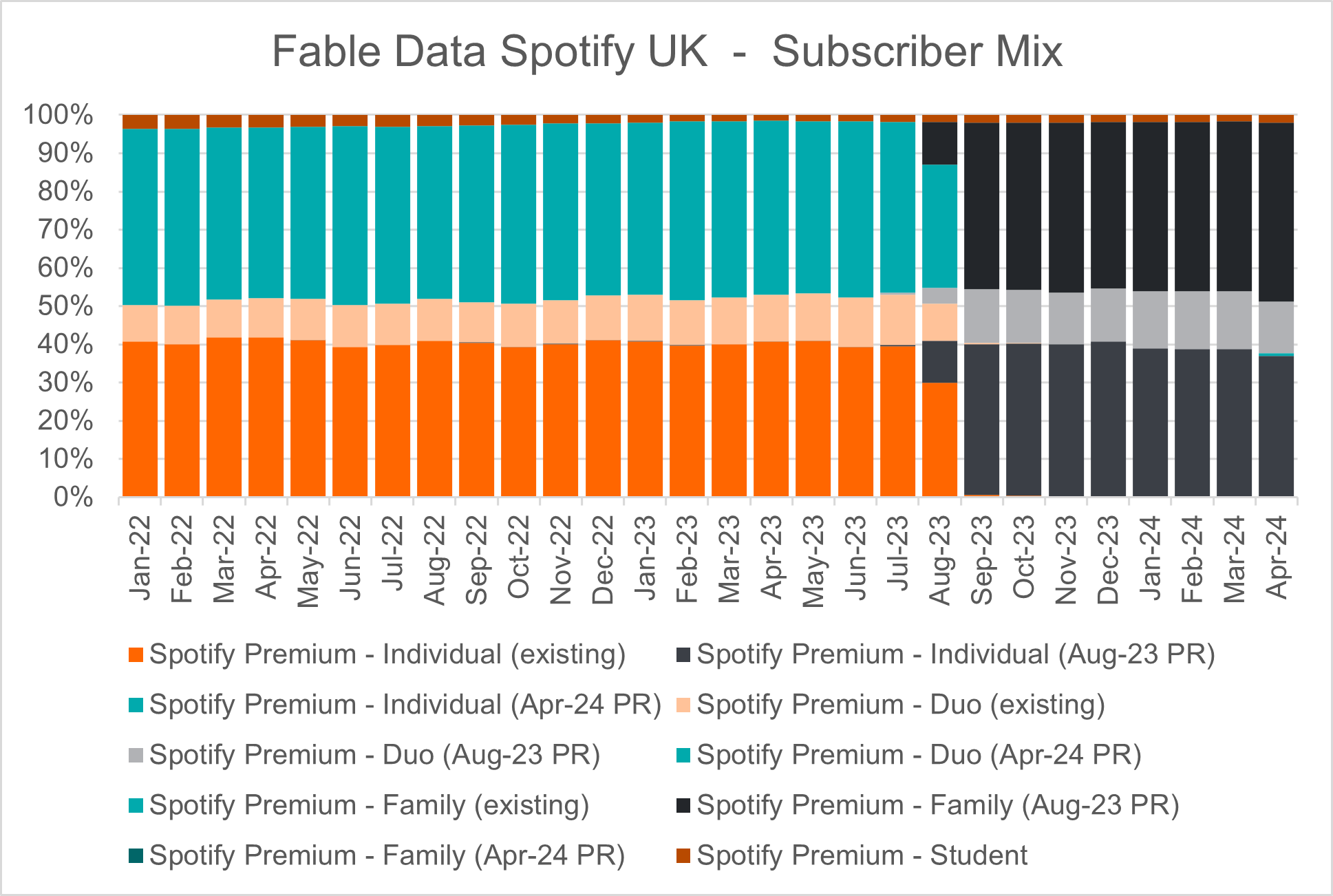

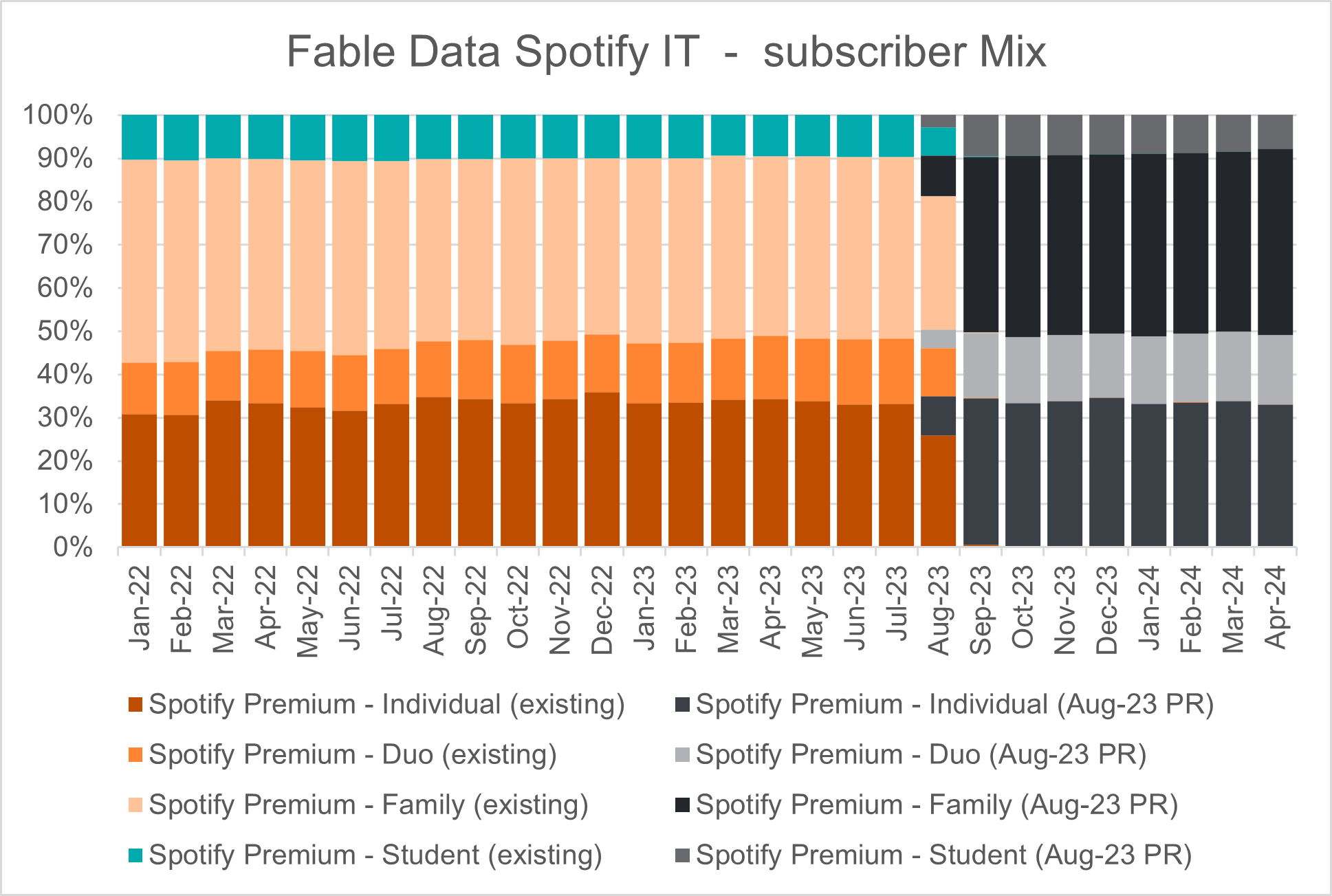

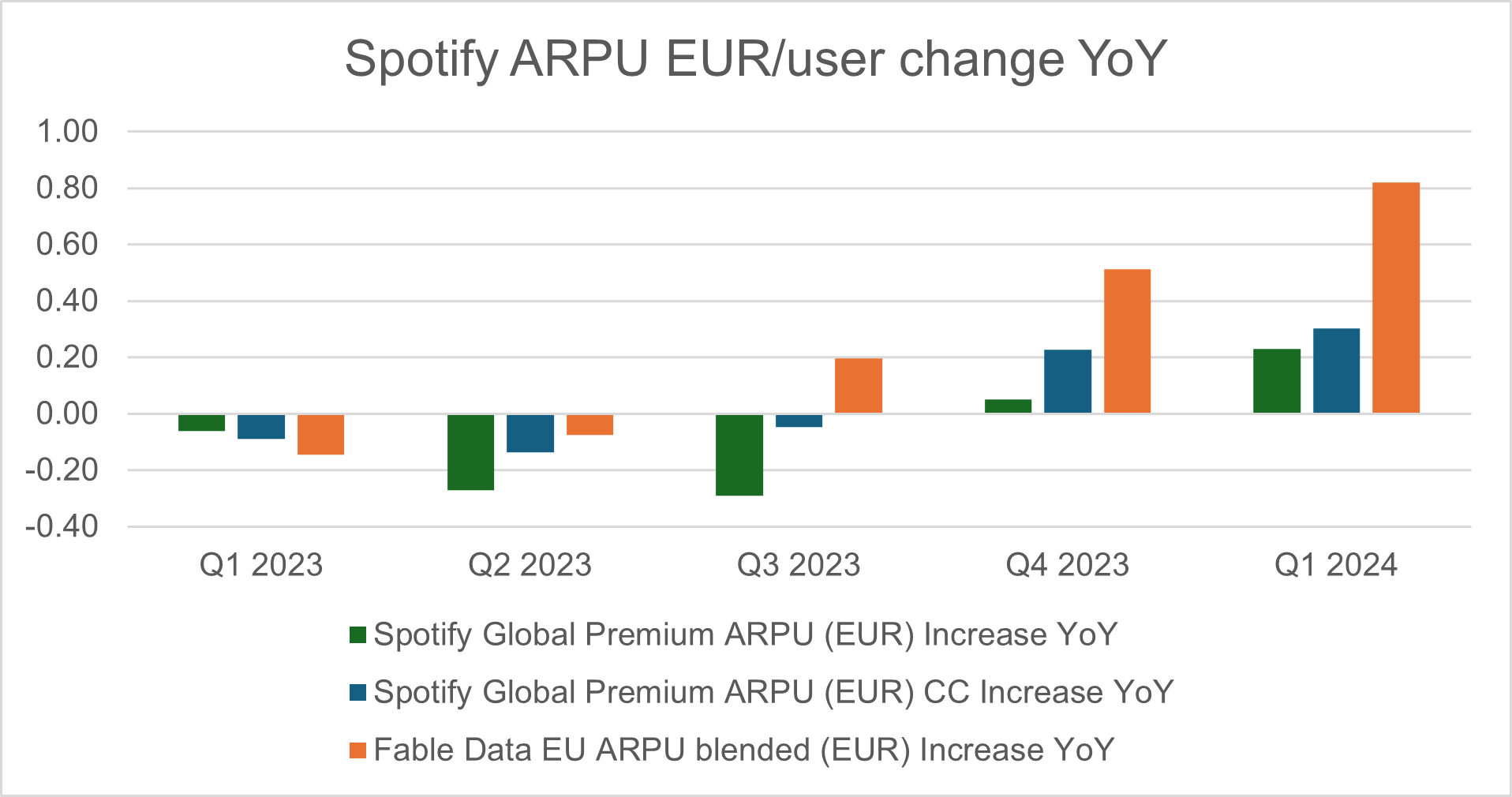

Price rises have been seen across subscription-based offerings over the last year including Netflix and Disney+. Spotify implemented its first ever price rise in mid 2023, with Fable Data indicating a relatively seamless transition and only a marginal shift in the subscriber base towards more affordable (per subscriber) DUO and Family plans.

How sustainable are the rises for Spotify’s highest paying customers – Europeans?

As Spotify’s CEO maintains the intention of ‘delivering on that ambition…2024 as the year of monetization’, we’ll be tracking the coming months and quarters closely as the company looks to execute on their strategy.

How much further can price rises be sustained in a region already paying higher prices than the rest of the world?

Fable Data highlights that price rises in Europe have already led price rises across the group. With a second price rise in under 12 months announced in the UK, and other countries likely to follow, we will be looking out for any signs of consumers trading down in the coming months.

Will increased plan flexibility cause a shift towards lower priced plans, as witnessed for Netflix and Disney+?

Spotify is also expected to announce new plans with multiple price points and offerings e.g. audiobook only (in addition to price rises). We will be tracking the impact this flexibility has on consumer plan preference and the overall willingness of consumers to pay higher prices.

Other subscription based entertainment streaming services, Netflix and Disney+, have similarly announced new plan offerings and seen a strong mix shift towards lower priced ad plans, particularly across new subscribers. See our recent Netflix analysis here: https://www.fabledata.com/netflix-with-ads-or-without-ads-that-is-the-question/

With this in mind, we will be watching closely for any similar mix shift towards lower priced plans and the impact this will have on Spotify’s overall performance. Watch this space.