Who Won the 2024 UK Black Friday and Festive Shopping Period?

Retail business models rely on sales spikes over the festive December period, and Black Friday before that, as consumers increasingly seek the best deals ahead of gift-giving in December.

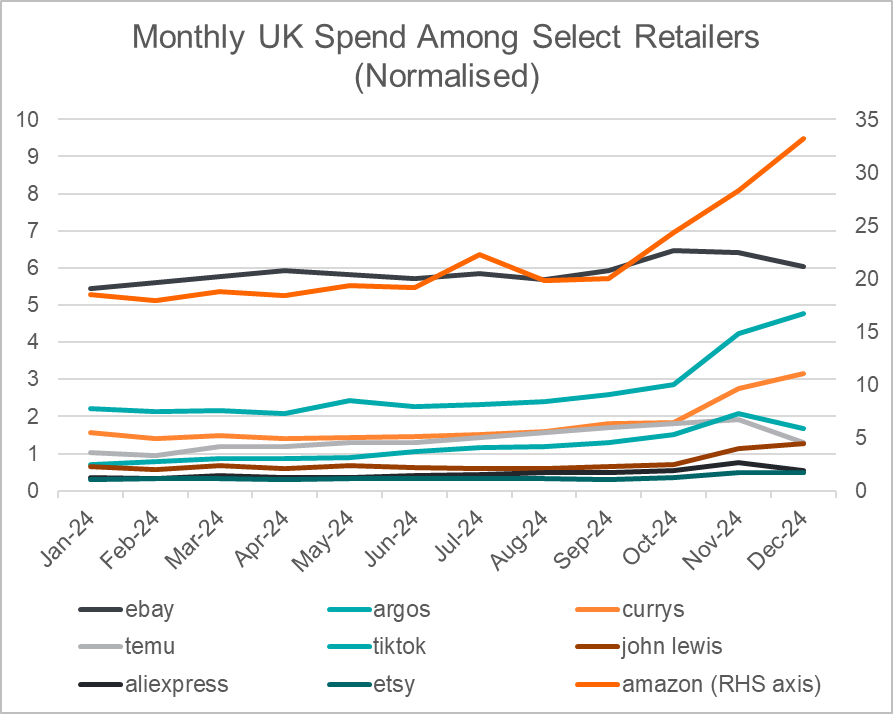

We explored who the UK winners and losers were at the end of 2024 using Fable’s UK consumer spend panel. Not only did we look at total spend and spend growth, but also market share to differentiate performance between of all those retailers whose spend increases across Black Friday and the December period.

Argos, Currys and John Lewis declared the winners

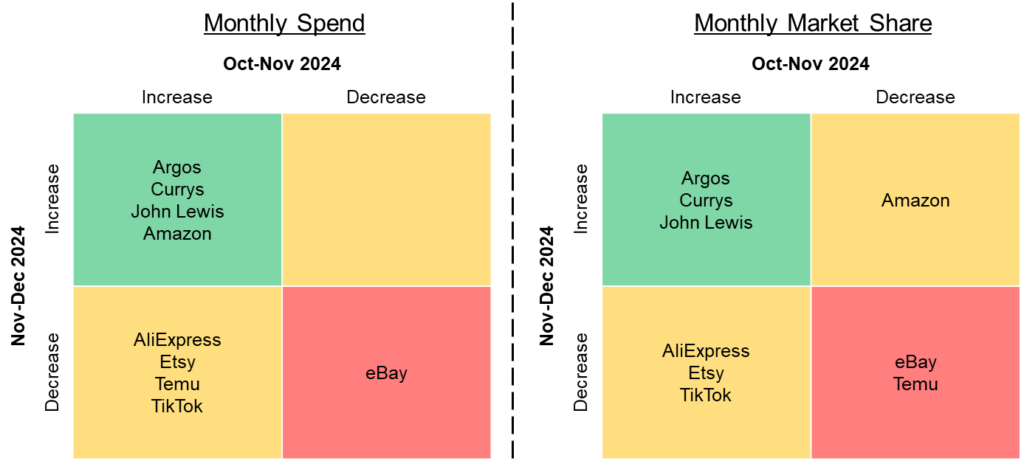

Among a select group of retailers serving UK customers, Argos, Currys and John Lewis are the winners of the 2024 festive period having successfully increased their total monthly spend and share of spend in both November and December.

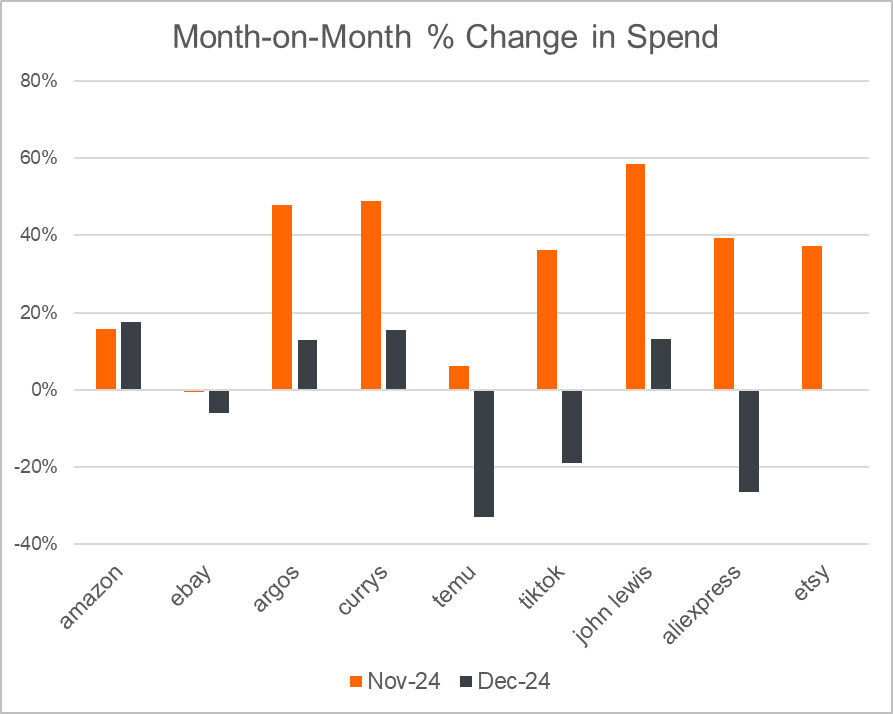

Not all Black Friday winners can be December winners too

November is a significant month for retailers with Black Friday deals bolstering spend and, for many retailers, spend increases further in December as the festive shopping season continues. However, Temu and TikTok are notable exceptions where month-on-month spend increased in November but dropped in December. This could indicate a consumer trend that favours ecommerce platforms such as Temu and TikTok for more general spending in November and indeed across the rest of the year, but less so for festive gift-buying where they turn instead to the more traditional retailers.

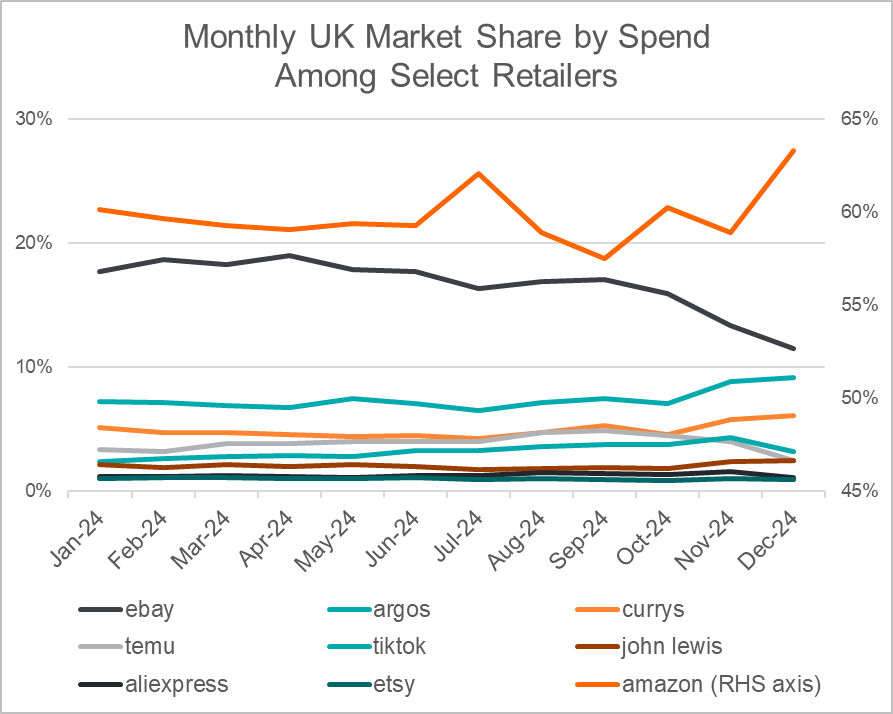

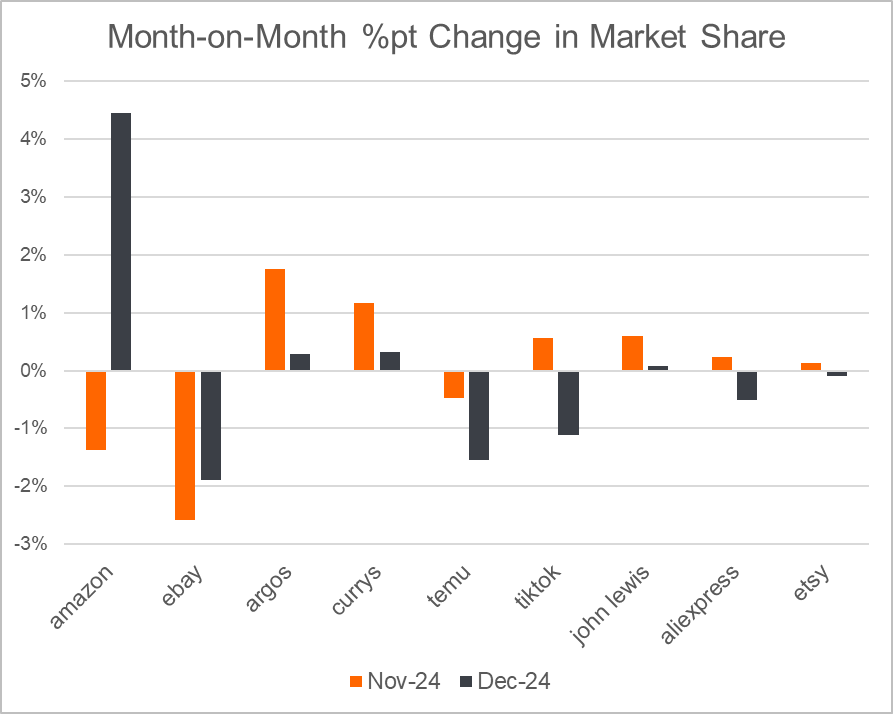

Spend might increase but market share tells a different story

Not all retailers experienced the same rate of growth in spend. Amazon’s share of spend fell in November but reached a new high in December, while TikTok experienced a Black Friday boost followed by a December slump. Argos, Currys and John Lewis successfully expanded their share of spend in both consecutive months.

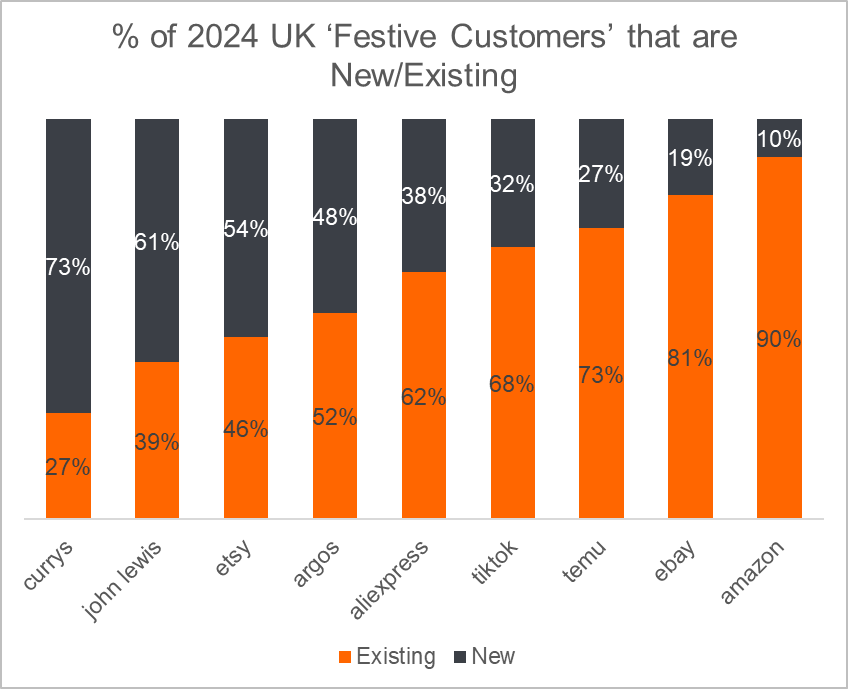

Discount deals and festive shopping mean new customers and increased online spend…for some

The majority of Currys and John Lewis December 2024 shoppers were ‘new’ – placing their first purchase of the year during the festive shopping season (here defined as 18/11/24 – 25/12/24)) – another sign that these more traditional retailers attract higher numbers of shoppers (new and existing) for the purpose of gift-buying compared to other times in the year. Amazon, on the other hand, might appear to retain a more steady base of returning customers year-round with just 10% of their November-December customers being new.

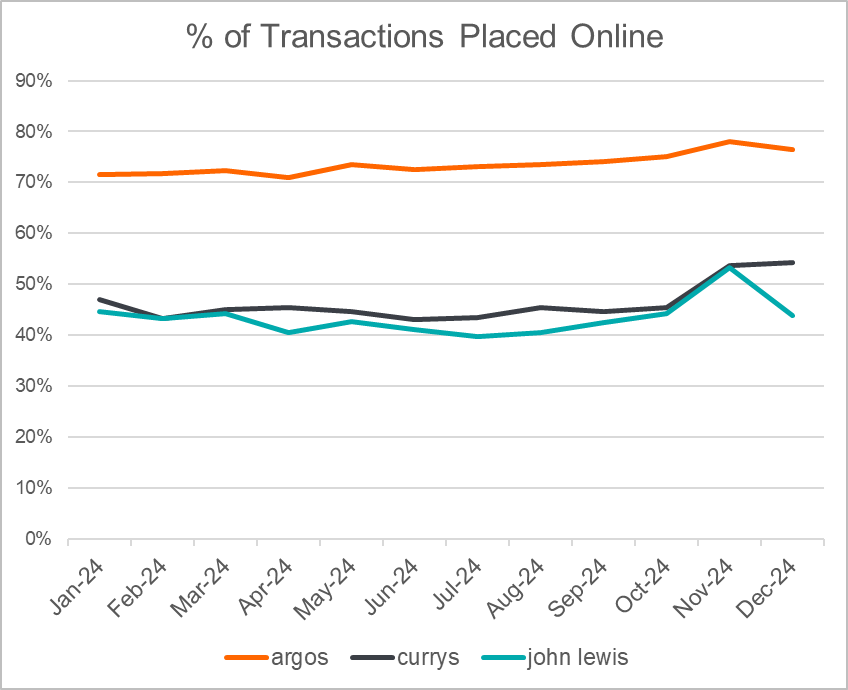

The share of orders placed online increased in November and December for Currys, however John Lewis saw a similar November lift, but then a return to normal levels in December. Whilst this indicates a consumer preference for Black Friday shopping online across many retailers, it reflects a preference for the in-person shopping experience at large stalwart department stores such as John Lewis over the festive season.

For more insight into retailer and ecommerce consumer spend trends in the UK and across Europe, please get in touch at info@fabledata.com