Where do we go from here for BNPL?

Buy Now Pay Later (BNPL) is the latest reincarnation of consumer borrowing and has quickly dominated the conscience of the consumer, the media, concerned regulators and incumbent mobile/electronic payment platforms and wallets.

Here, I briefly trace the origins of consumer debt for context and then bring the narrative forward to a current review of the BNPL landscape and what Fable’s consumer spend data is telling us about BNPL consumers and their usage, its popularity, the effect it is having on established payment providers and what this might mean for the future.

Grain, the currency of Kings

It might be tempting to consider loans and the willingness of consumers to embrace the “never never”, or regular payment instalments as we think of them today, as a relatively recent by-product of sophisticated global banking systems. However, money lending can be traced back to about 3000 BC in ancient Mesopotamia, when food was the original currency, and in 1800 BC we know King Hammurabi formalised the first known lending laws for Babylon’s inhabitants, to help farmers purchase grain.

The Industrial Revolution saw manufacturers embrace scientific advances that acted as the catalyst to usher in an era where manufacturers around the globe produced goods and services for the average consumer at an unprecedented pace. Simultaneously, astute corporations, innovated rapidly to offer consumers financial solutions to more readily enjoy the benefits of these goods and services. The consumer not only profited from a better quality of life but also experienced wholesale changes in the labour market, as this new wave of consumerism created more skilled employment opportunities.

Screech forward to this Millennium and the last decade has witnessed a dramatic rise in payment facilities that have seamlessly closed the gap between the consumer’s intention to buy and the mechanics of the payment itself. As consumers ubiquitously demanded convenience on their terms, they embraced better mobile technology and were subjected to an ever-increasing number of electronic channels to engage, distract and entice. Consumers unknowingly unleashed a war amongst these technological giants, each vying for a profitable slice of their wallets.

The exponential acceptance and growth of BNPL during Covid

Since the start of this year, Fable Data has been actively analysing payment wallets and payment processors from the live consumer transaction data that we collect from banks and credit card companies.

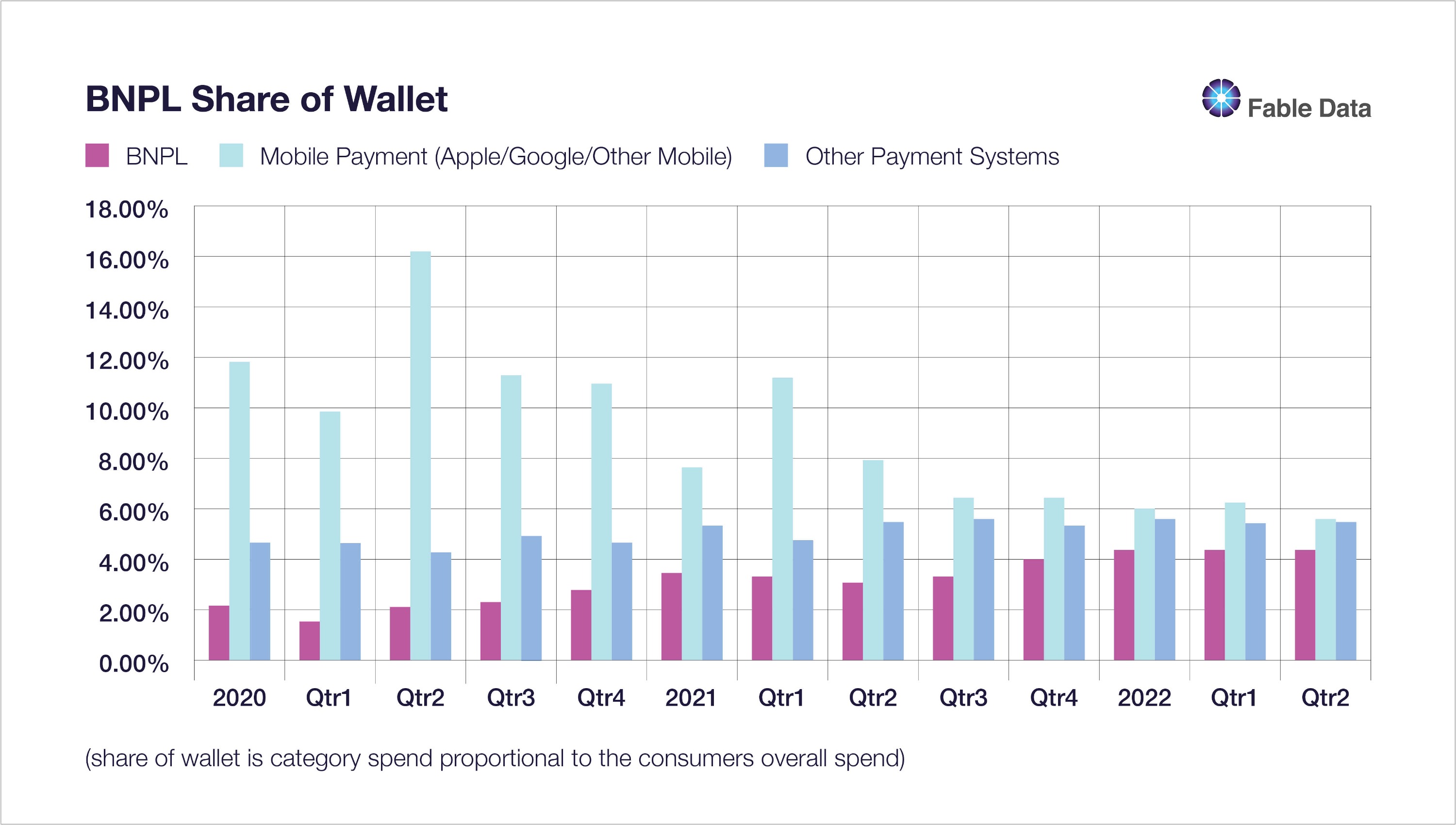

Our analysis is based on observing providers such as Apple Pay and Google Pay; platforms like Paypal, Square, SumUp, iZettle and the new BNPL platforms. Over just two years, BNPL platforms have captured over 5% of the consumer wallet, growing from as little as 1% pre-Covid – that’s a staggering 400% growth. BNPL platforms are now on a par with incumbent platforms like Apple Pay and Google Pay, which have ceded ground, losing over 50% of their pre-Covid share. ¹ So we weren’t surprised when Apple Pay recently announced its intention to foray into BNPL, and Paypal indicated that it was furthering its Paypal Credit offering.

After a strong start, new customer acquisition numbers rapidly declined

Throughout Covid, BNPL providers voraciously acquired consumers, beginning, perhaps surprisingly, with the more affluent groups. However, as the pandemic lockdowns intensified, traditional avenues of consumerism were reduced, leading shoppers to shift focus and embrace more online avenues. This resulted in less affluent consumers embracing the notion of “consume today pay tomorrow” and subsequently a more serendipitous and ubiquitous adoption of BNPL.

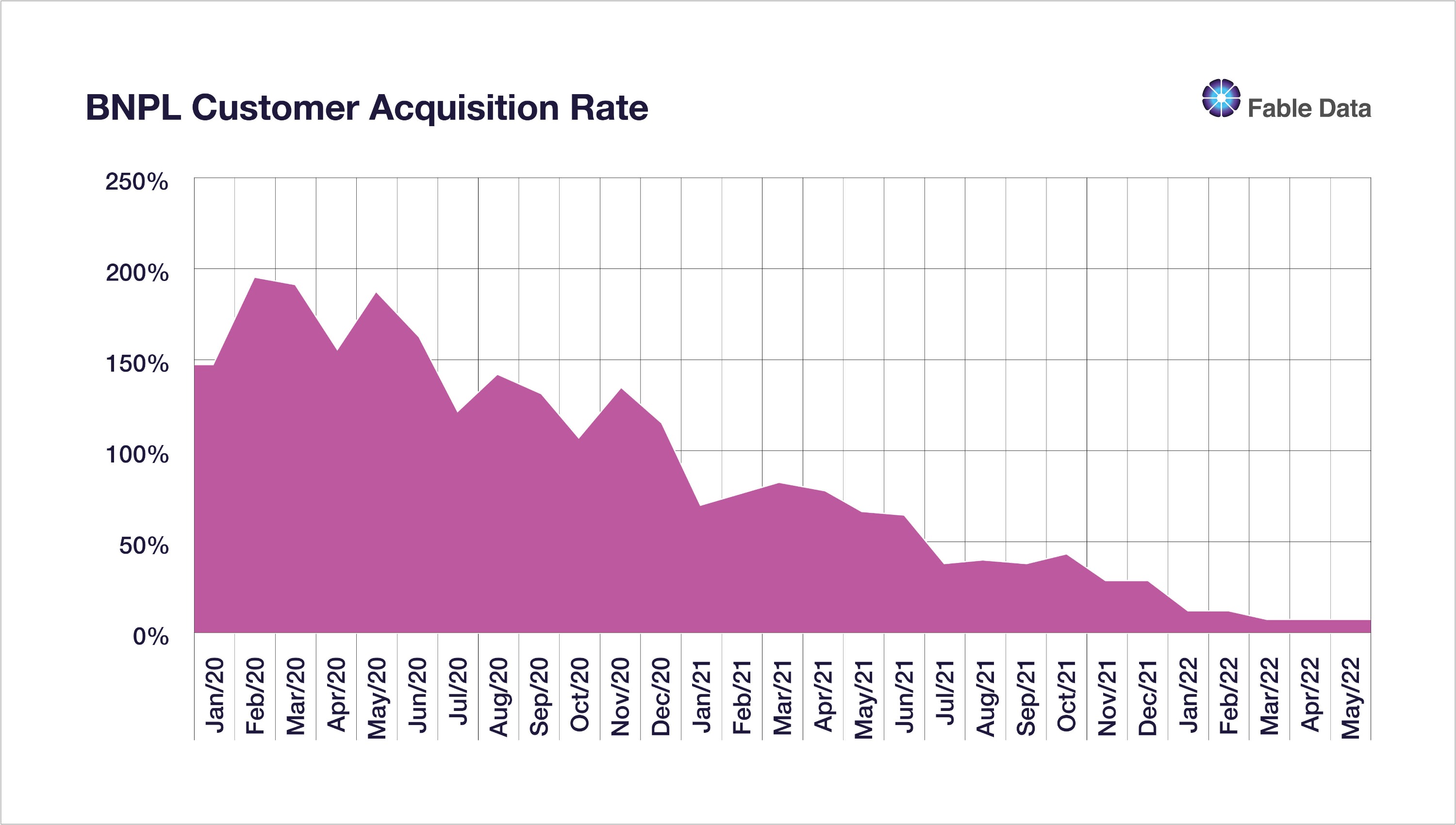

During Covid the growth (year over year) in the number of new BNPL customers averaged well over 100% every month, but in more recent times this growth has significantly ebbed and is now meandering in the region of single digits.

²So it again came as no surprise to us when in May leaders at large BNPL institutions signalled a move away from growth via customer acquisition in favour of a larger focus on overall profitability.

What do we know about how consumers are choosing to use BNPL?

With the broad-based adoption of BNPL, Debt charities such as Step Change have sighted concerns that nearly 30 per cent of Britons have used this new channel. ³At Fable, using a nationally representative base of consumers using UK credit cards, we observe an average penetration of 25% (of our BNPL focussed data) across England and Wales.

Fable’s data shows that regional take up is remarkably similar across England and Wales

There is no doubt that the current cost of living crisis has forced many consumers to take on more debt to finance spending in non-discretionary consumer categories, and a quick scan of the media presents numerous concerns from commentators fearful over BNPL debt escalation and what the damaging implications might be for consumers who become reliant on this finance channel for long term survival.

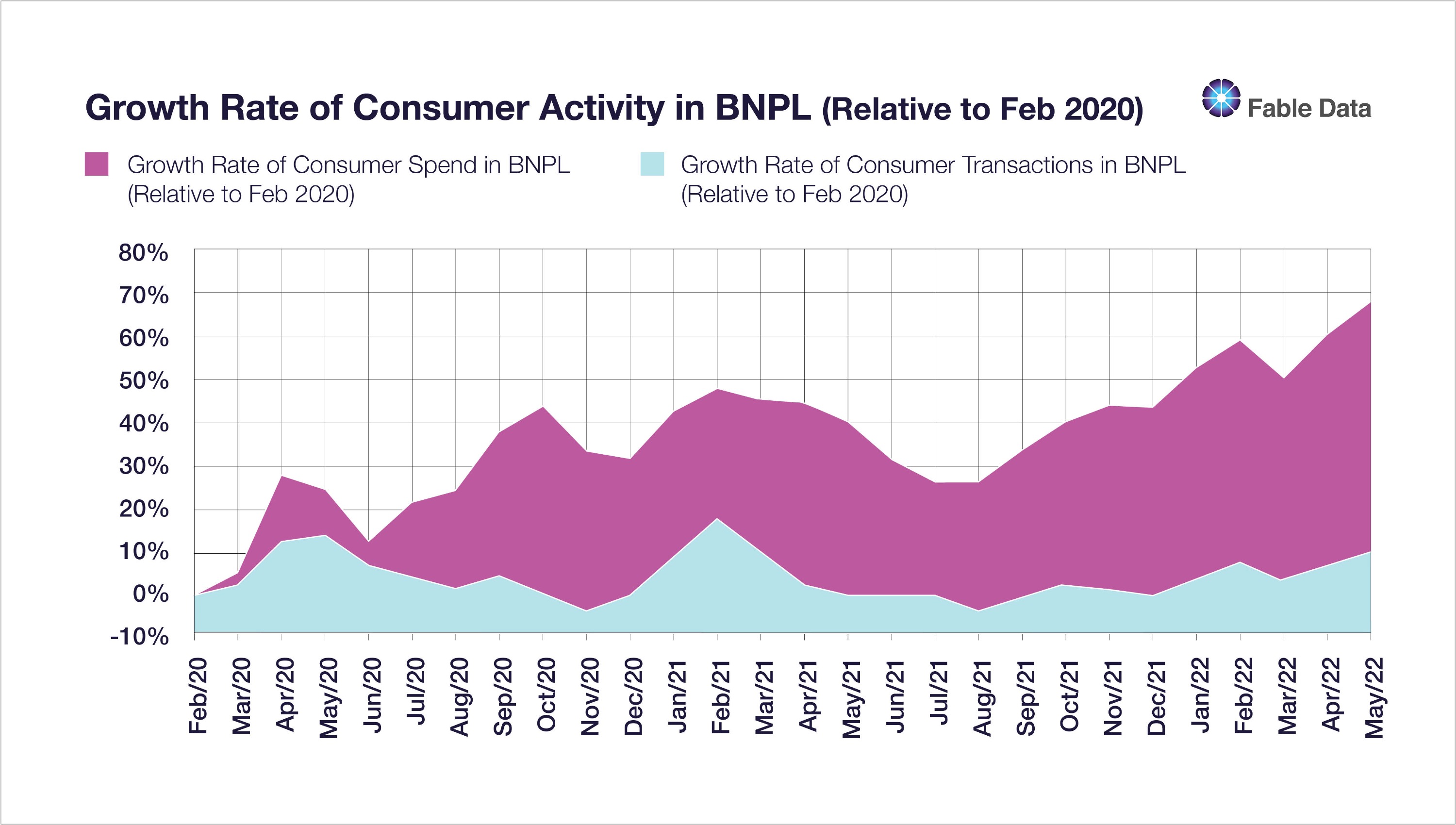

Estimates in the media suggest that BNPL consumers are at present paying off an average of 4.8 purchases compared to 2.6 earlier this year. When Fable analysed a cohort of credit card consumers who exhibited relatively high usage of BNPL, we observed that the BNPL spend recorded has increased by over 65% from February of 2020. This broadly corroborates with the 85% increase in BNPL payments observed in other data and surveys published in the media.

However, interestingly we also observed that the number of transactions has not also proportionately increased. This could imply that debt repayments from prior purchases are accumulating and therefore represent the main driver of this increase in payments. There is also the possibility that these consumers might also be using BNPL to buy higher-value one-off ticket items too.

So, where do we go from here for BNPL?

As the cost-of-living crisis rolls on, we could see BNPL usage penetrate deeper into the population. Incumbent BNPL providers with falling new customer acquisition rates will need to work harder to retain existing users which could spur even deeper consumption amongst those already heavily reliant on BNPL.

While other payment systems could vie to acquire those consumers not yet served by incumbent BNPL platforms and to this extent, we have also witnessed neo banks entering the landscape. Coupled with favourable lending terms and access to consumer bank accounts, Neo banks with existing loyalty programs and a BNPL-type lending scheme could very well displace BNPL platforms that boast of building loyalty for merchants.

With acquisition rising again and loyalty increasing, the hidden leverage being created in the financial system is bound to increase over time. The Bank of England’s recent actions to raise lending rates by 1/2 of a percentage point, one of many more hikes to come, has raised concerns around the affordability of debt financing not just for cash-strapped borrowers.

This increase as yet does not pose a problem for BNPL schemes, which do not charge interest. But as regulatory scrutiny increases and as consumer delinquency rates rise, BNPL lenders could be forced to charge (more) interest or impair the favourable terms they offer today. Another possibility is that BNPL platforms could be forced to set aside capital, as do banks and other credit facilities, to cover the cost of future delinquencies. Such a move will increase the operational costs of the BNPL landscape rendering the weaker BNPL platforms less viable and potentially inducing a rash of consolidation in the space.

History, we are told, repeats itself, although a little differently each time. Innovations in the realm of consumer lending never cease, and there are always corporate casualties. But in the long term, the consumer has always won. Why would this time be any different?

Sairam Kamath, Chief Innovation Officer, Fable Data, Sai@fabledata.com

https://www.investopedia.com/apple-announces-buy-now-pay-later-5324814 ¹ https://on.ft.com/3sZTRrX ²

https://amp.theguardian.com/business/2022/jun/23/buy-now-pay-later-uk-research ³

About Fable Data

Fable Data is an Award winning pioneer in the European real time consumer transaction data market. We own the most comprehensive anonymised dataset of European banking and credit card data, supplied directly from source and based on millions of European consumers.

In addition to partnering with leading financial providers, Fable has a stellar client base of global Tier 1 Investors and Fortune 500 companies. We also work closely with central banks, institutions, and academics, to ensure that our ground breaking data and analysis is shared, at no cost, with global decision-makers.

Fable’s real-time view of the global economy informs better decision-making in business, government, research, and development.