Fable’s Macro Dataset Reveals the Dynamism of Consumer Behaviour

How have the fluctuations in the macroeconomic environment impacted consumer habits over the last 5 years?

From the pandemic lockdowns and re-openings to a world of soaring inflation and higher interest rates, the fluctuations in the macroeconomic environment have seen consumers’ habits rapidly change over the last 5 years.

Fable’s transaction dataset is ideal for capturing the dynamism of consumers across the major European economies. Our Macro Product aggregates our billions of rows of data into well-defined sectors per country at a weekly frequency and provides a view of consumer behaviour a quarter before official sources.

Here we focus on three sectors – Groceries, Restaurants and Electronic Goods, looking at annual wallet shares to understand how national expenditure habits change over time, using 2019 as our benchmark.

Our three key take-aways:

- Grocery share of wallet remains higher than pre-2020 given its non-discretionary nature and soaring food inflation.

- Restaurants post-pandemic ‘revenge spending’ loses momentum but maintains its high share despite higher prices.

- Electronic Goods stores share is seeing ongoing decline since pandemic highs, indicating consumer enduring preference for experiences over goods.

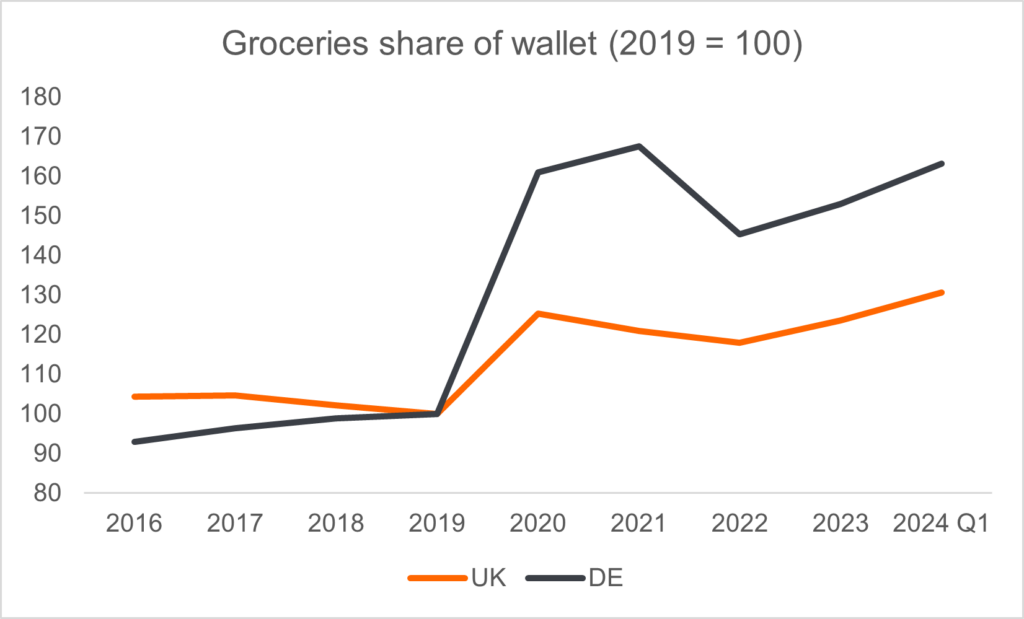

Grocery

- Grocery share of consumer expenditure peaked in 2020 as supermarkets remained open while many other stores closed.

- Share eased in 2022 – the first full year without lockdowns – but has since risen again, remaining far above the pre-pandemic share.

- Soaring food inflation may be responsible given the non-discretionary nature of grocery spend.

- Food inflation has been falling of late, but prices continue to rise, as implied by the increased share in Q1 2024.

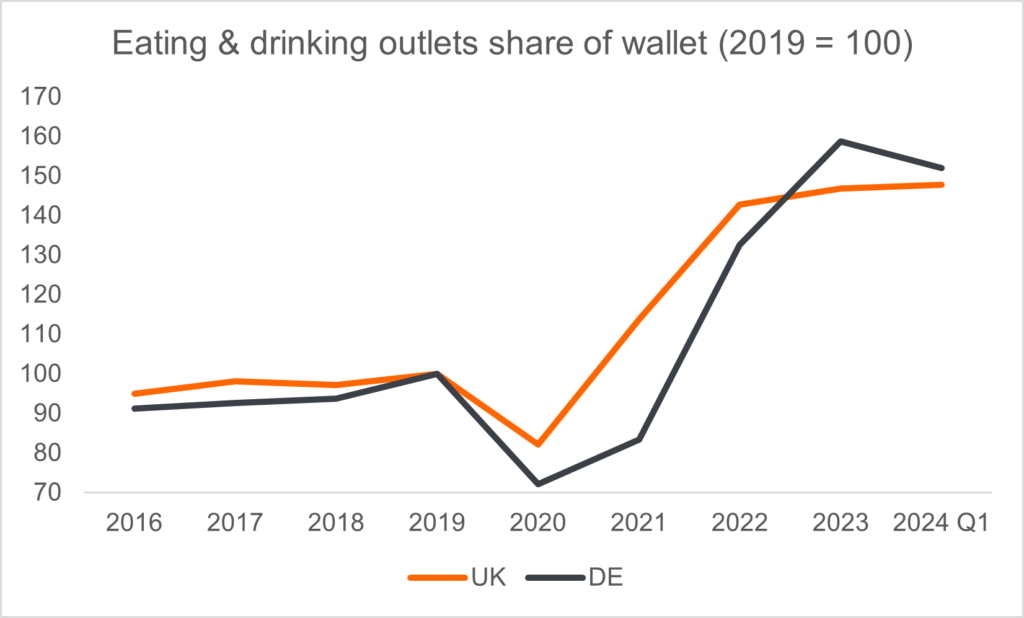

Restaurants

- Online food delivery services prevented a steeper drop in share for restaurants and bars when forced to close in 2020.

- Share jumped far beyond pre-pandemic levels once lockdowns ended as consumers opted for in-person services rather than physical goods.

- Consumers may have been willing to absorb higher restaurant costs given post-pandemic novelty, contributing to the ongoing elevated share.

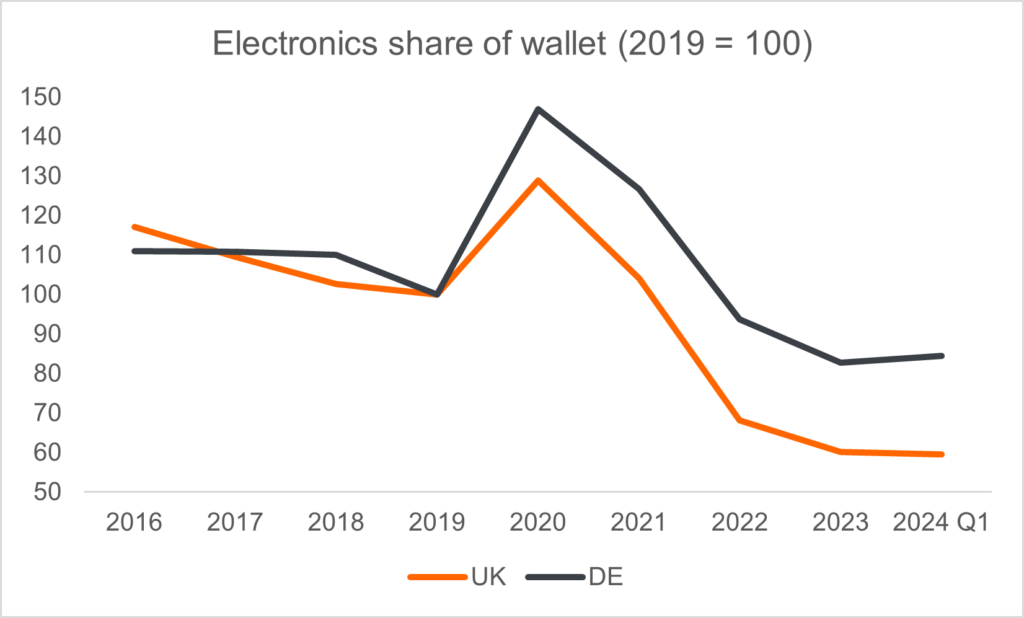

Electronic Stores

- In contrast, merchants selling electronics goods saw their share spike during the pandemic and then rapidly fall.

- Despite not seeing any further declines, the low share in Q1 2024 suggests that consumer demand for experiences at the expense of goods may be here to stay for now.

We have shown these changes on an annual basis to provide a high-level picture, but using Fable’s Macro Product, these results can be obtained on a weekly basis in near real-time to get a truly dynamic view of consumer behaviour.

The UK’s latest GDP print pointed to the economy emerging from recession in Q1, however, we will have to wait until the end of Q2 for the full consumer picture to be published.

In contrast, Fable’s Macro Product provided this view of consumer behaviour shortly after the end of Q1.

For more information, please reach out to anoop@fabledata.com or contact us.