Little disruption to plan mix from Spotify’s price hikes

Earlier this year we reported on the initial impact in Europe of Spotify’s price rises after the CEO claimed 2024 would be ‘the year of monetization’ following a series of price rises starting in July 2023 with more planned over the following year.

Back then we saw a relatively seamless transition to the price rises with only a marginal shift towards the more affordable Family and Duo plans. And it seems that there is little change to this trend a year on.

Our findings from our data indicate 3 takeaways:

1. Price rises have been implemented relatively seamlessly with little change in plan mix

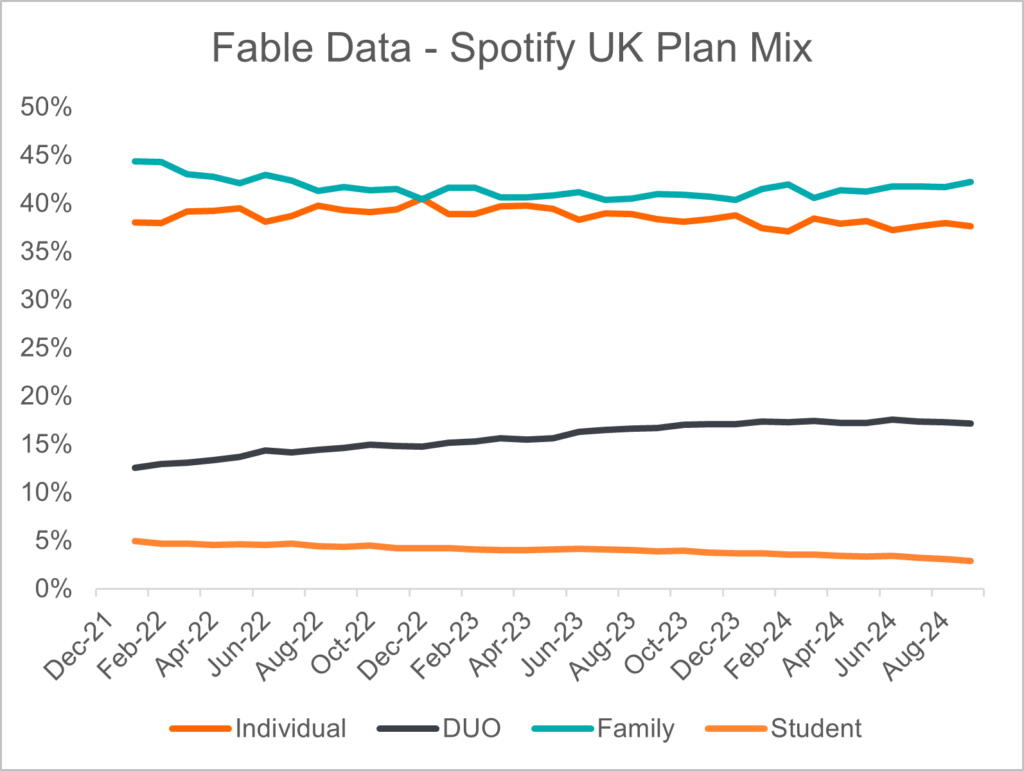

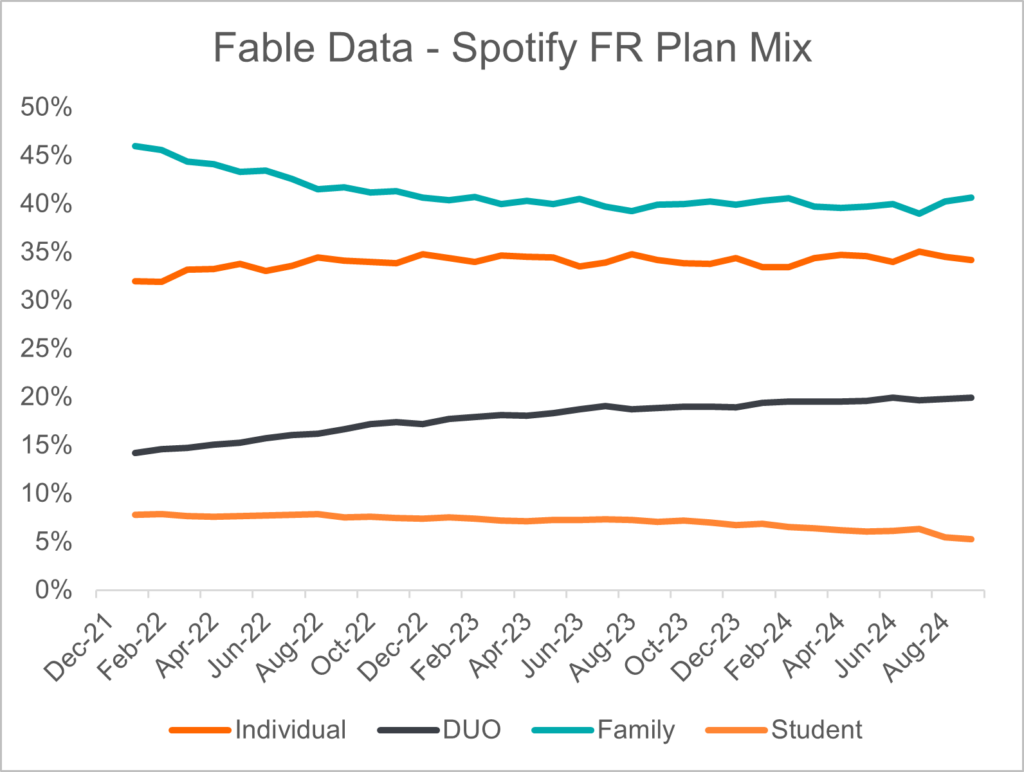

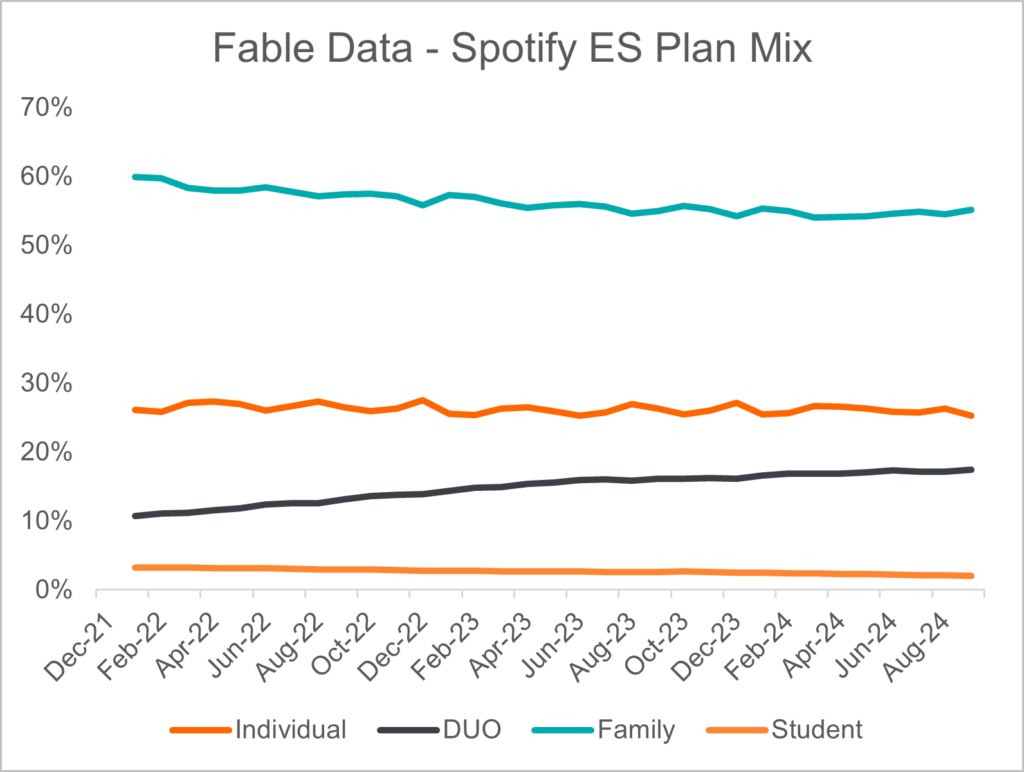

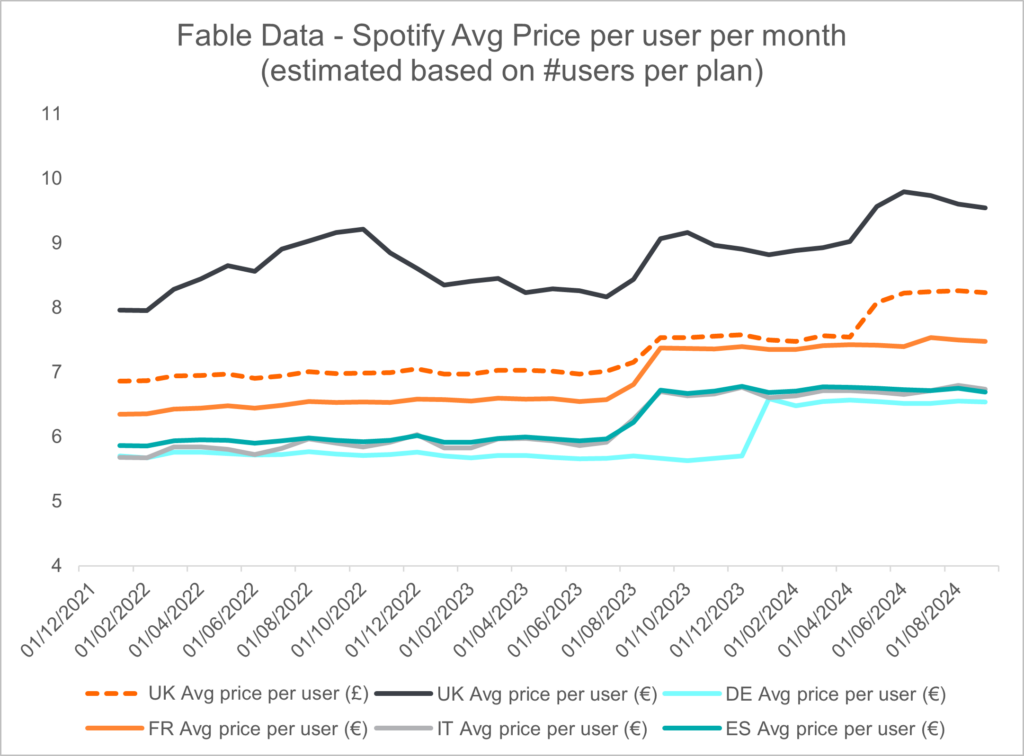

Recent analysis of our European consumer spend data indicates that whilst we see average price per plan and per subscriber increase, we see no further discernible change in plan mix since the price rises started in August 2023.

- Rather than disruption, we see a continuation in trends already in play before the rises.

- Family plans remain the most popular at 40-60% of plans and Duo plans continue to gain subscribers in most markets at 10-20% of plans.

UK, France and Spain analysis below; please reach out for analysis on Germany and Italy.

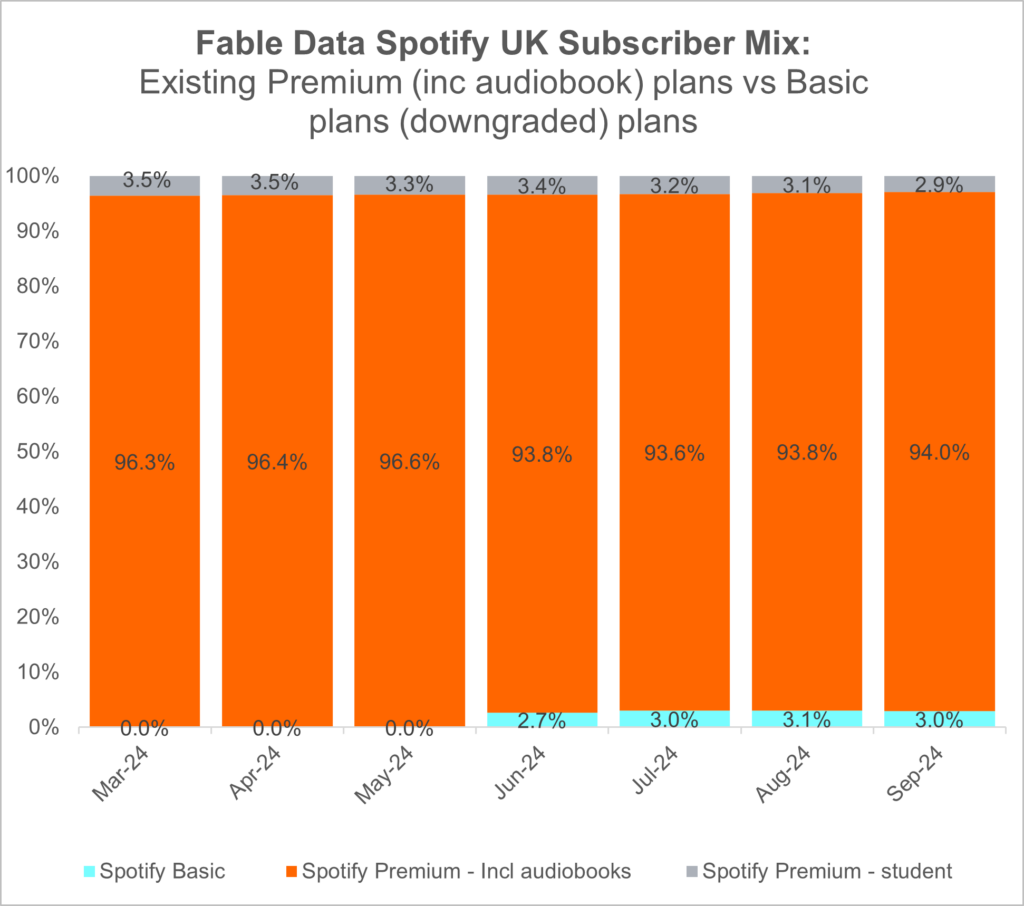

2. In the UK, only c3% of subscribers opted to downgrade plans despite price rises that included a new audio book element.

The April price rises in the UK included the introduction of audio books, with subscribers able

to opt out (downgrade) of the price rise by downgrading to basic (excluding audiobook) plans. We saw only c.3% of subscribers chose to downgrade to basic plans; another indication that price rises were relatively seamless.

3. The price increase across most regions will fuel much of Spotify’s 2024 growth

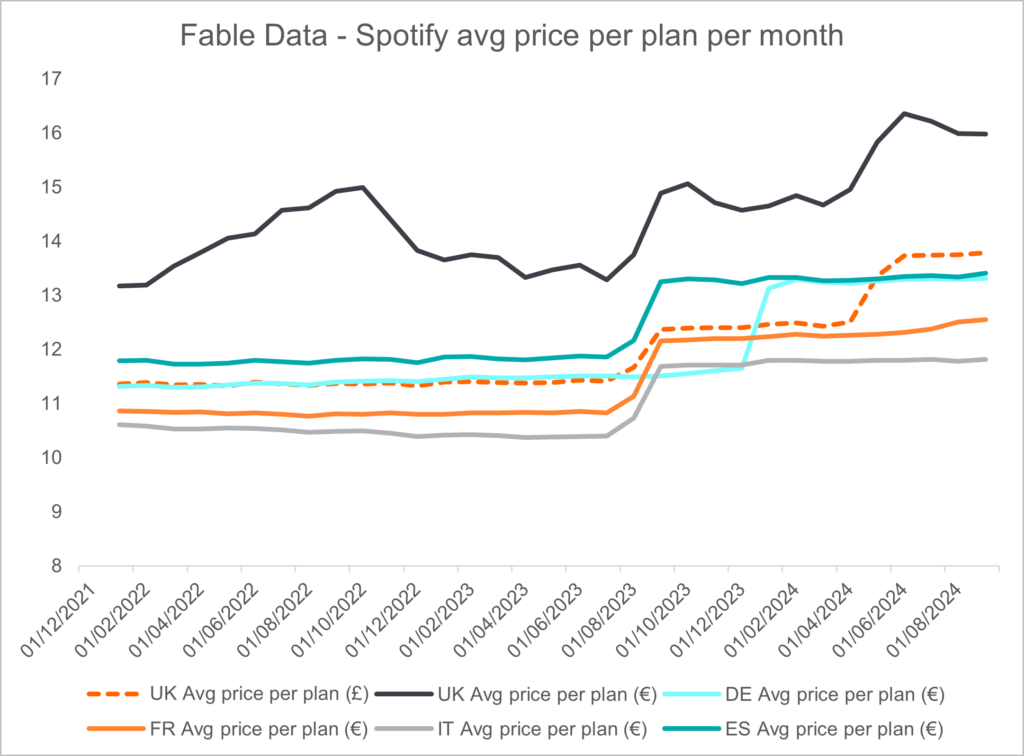

Over the last year, average monthly plan prices are up by c.13-15% across Germany, France, Italy and Spain while UK prices have risen nearly 20% following two prices rises in Aug-23 and Apr-24. This will fuel much of the growth in 2024 for Spotify.

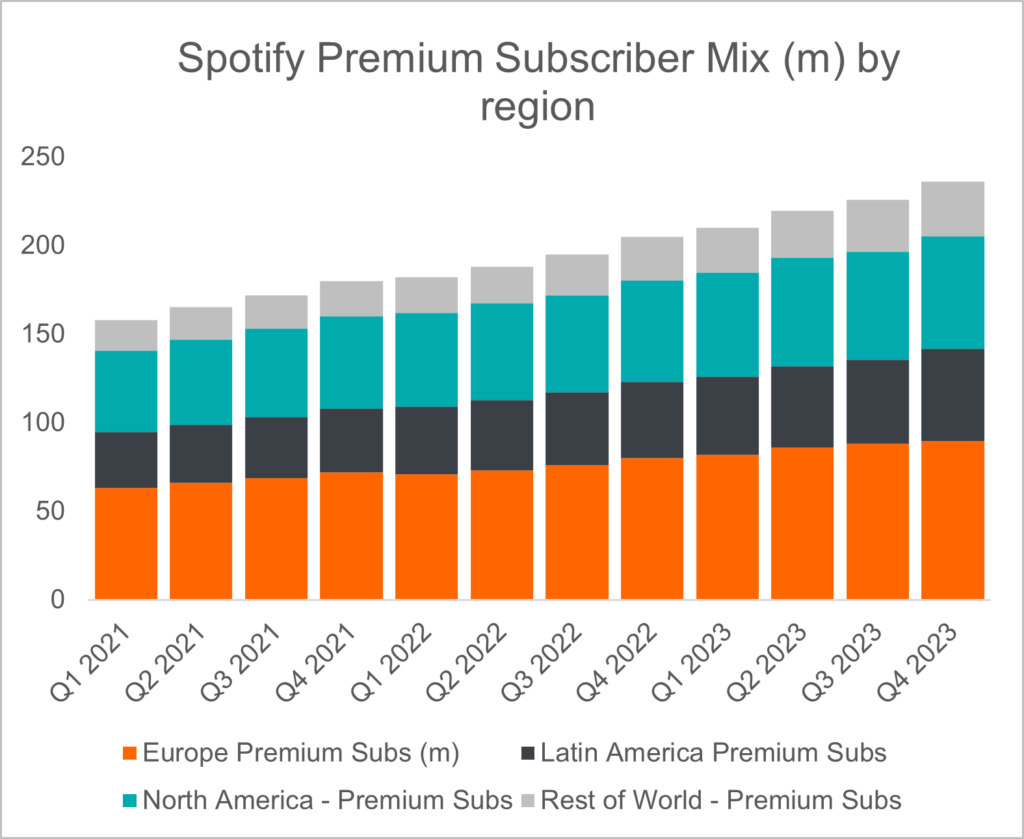

Why is Europe so important for Spotify?

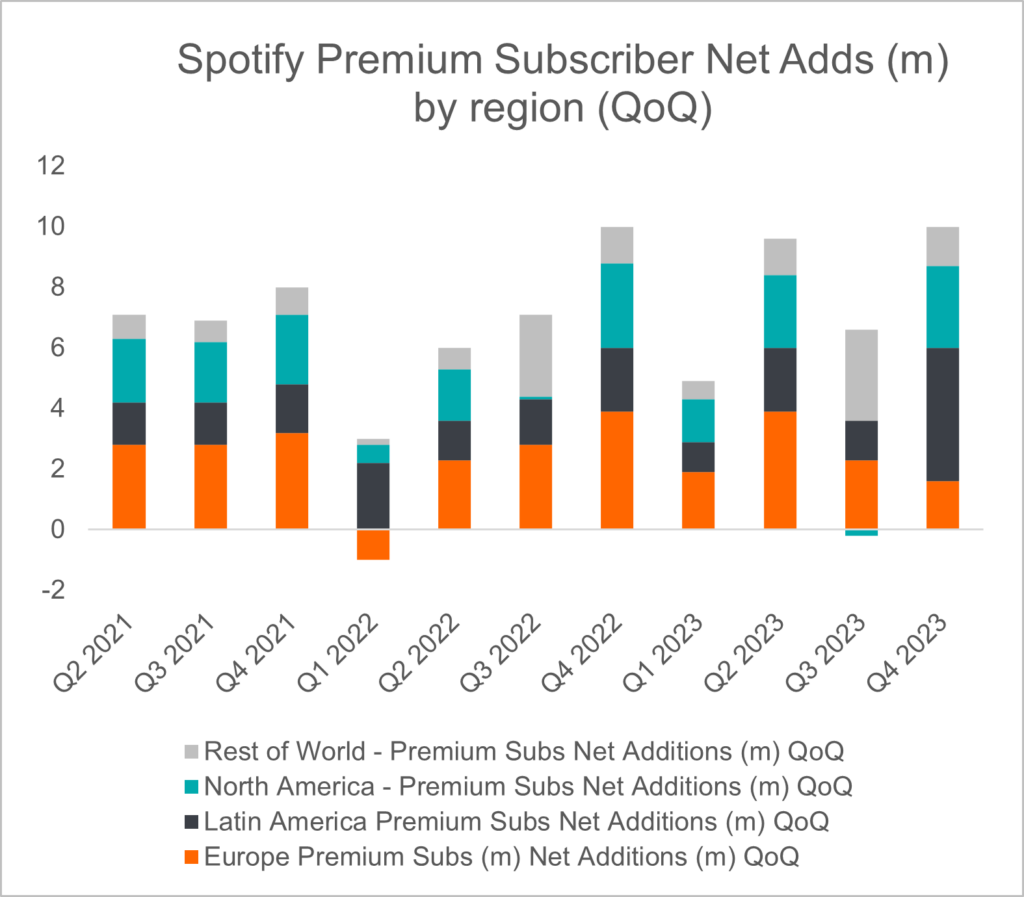

- Europe represents the largest proportion of subscribers at 38% of total (up from 29% 5 years ago)

- Europe added more subscribers than any other region in 2023 adding 9.7m subscribers, which was 30% of global net subscriber additions.

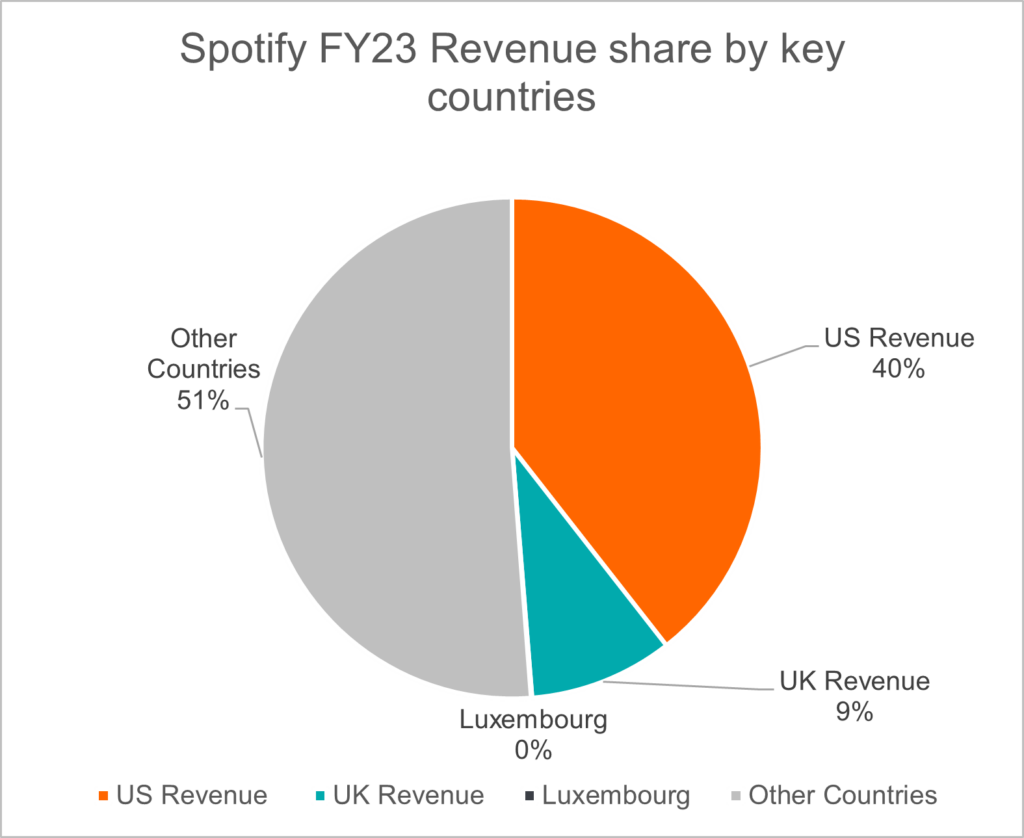

- Outside the US, the UK is the second most important country for Spotify. Collectively with Germany, France, Italy and Spain which sit just below the 10% reporting threshold, Europe is a significant piece of the revenue puzzle for Spotify.

Get in touch for the full analysis or to find out more about Fable’s European consumer spend data.