Order values falling: what does this mean for fast fashion online?

In an environment of increased competition and price-sensitivity, how much are customers spending in fast fashion online and how is this changing across brands and Europe?

Our European consumer spend data reveals the latest trends and how this has changed over the last 6-12 months, nuanced by brand, portfolio strategy and country.

Key take-aways

- The first half of 2024 has seen an increase in lower value transactions for online fashion compared with 2023, implying high competition, increased discounting and downtrading from customers.

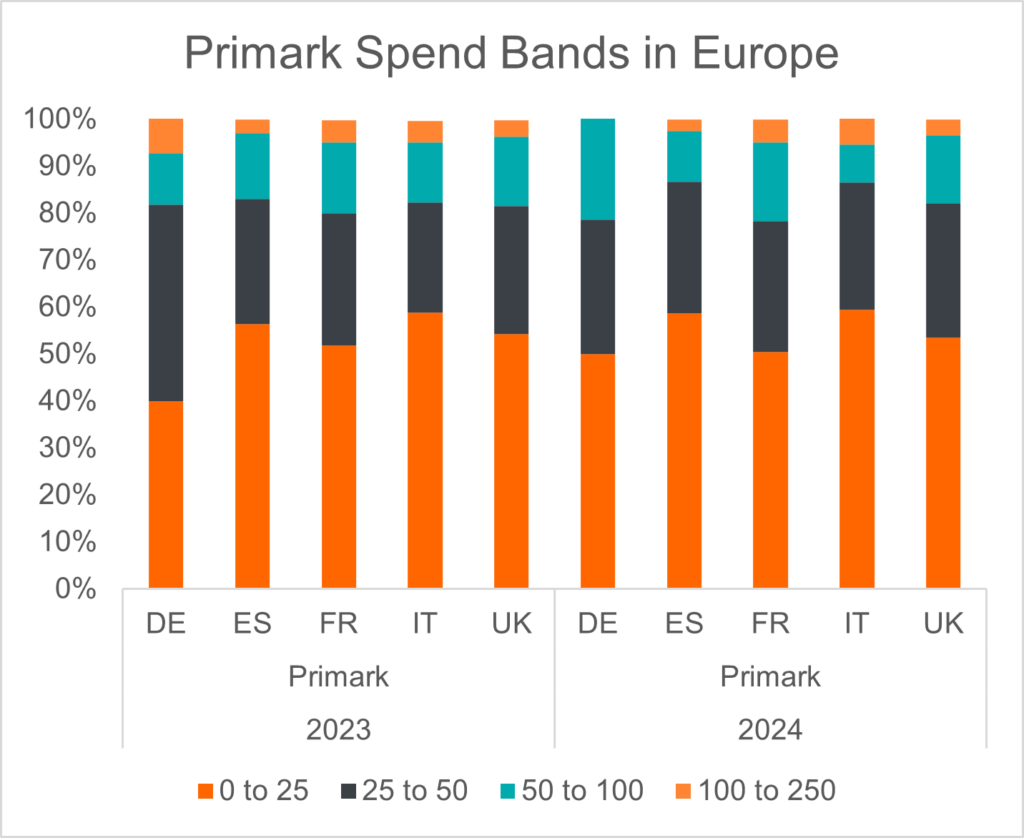

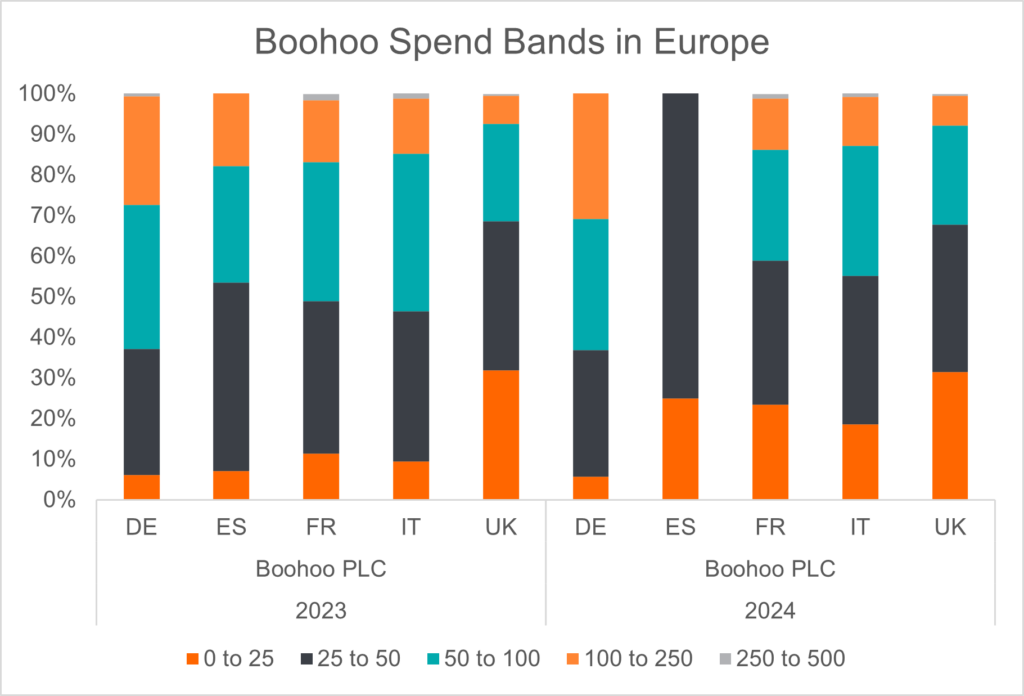

- 60% of online spend at fast fashion brands is concentrated in the lower spend band below €50 per transaction. H&M, Boohoo, Shein, Primark and Monsoon are amongst those in this camp, some with up to 50% of transactions <€25.

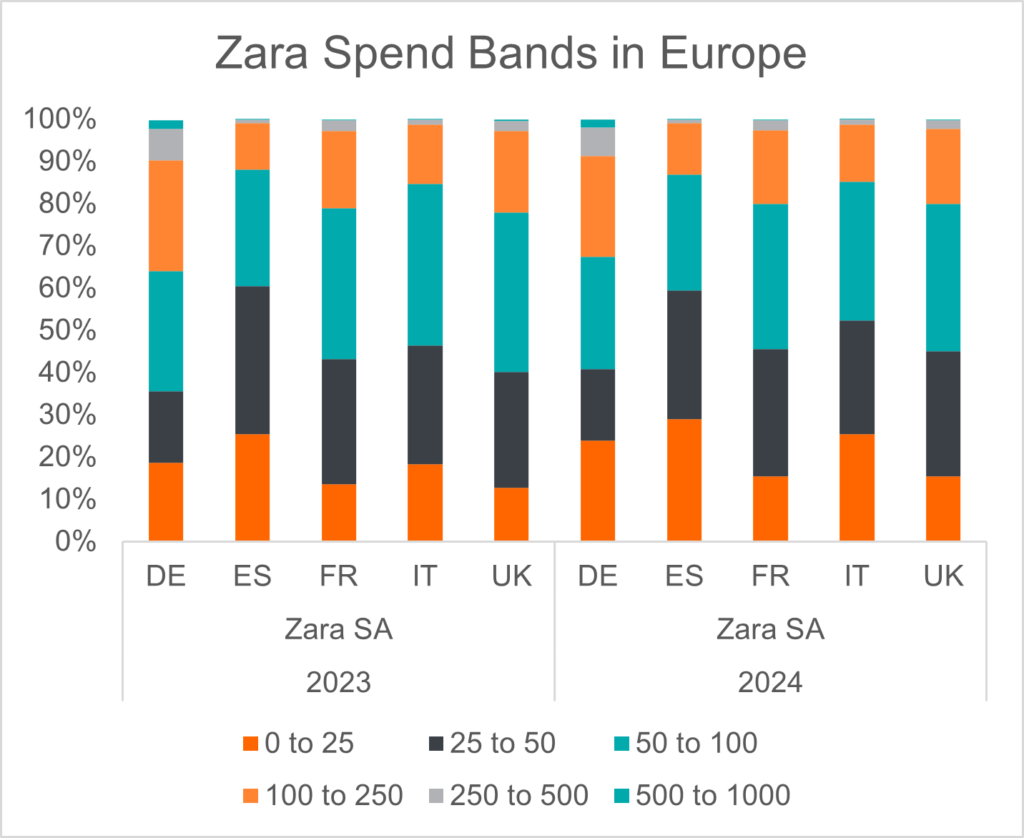

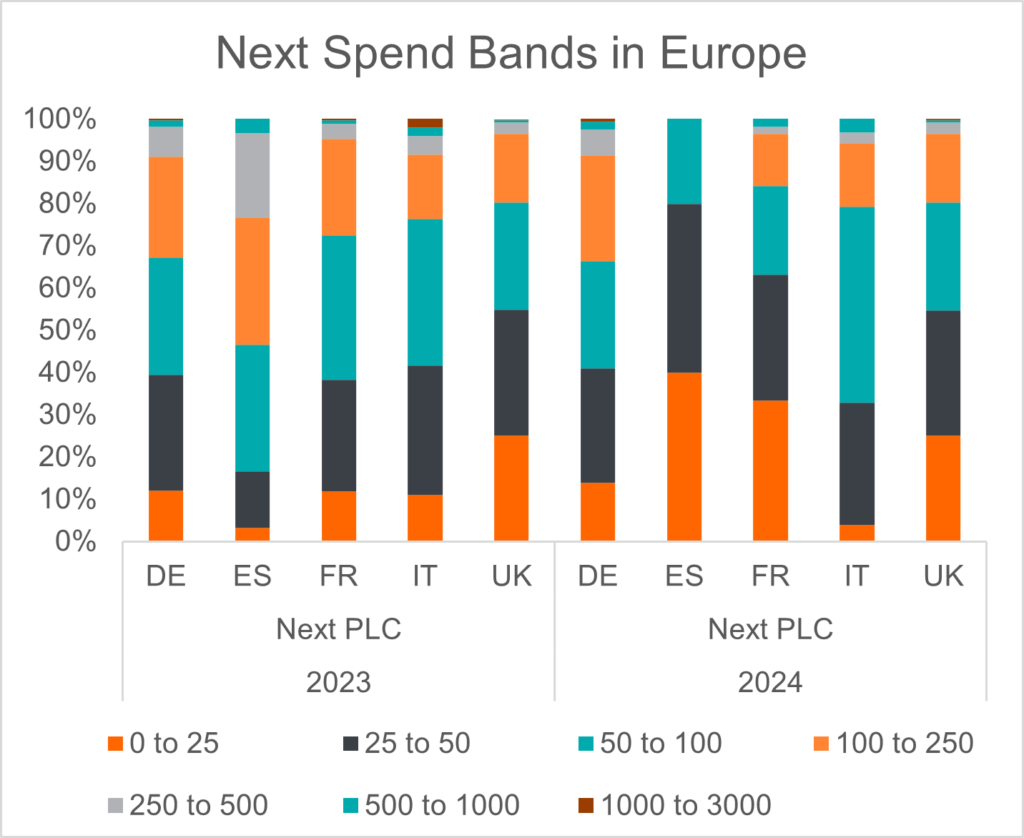

- At the top of the pyramid are Asos and Zara with 60% of spend >€50 per transaction. Next, Uniqlo and Primark have managed to dodge an increase in lower value transactions and have instead increased share in higher spend bands.

- Country and market-specific trends exist, in particular where companies price differently in their home country versus externally, and where competition is created between multiple players competing in the same spend band.

Continue reading for a breakdown across Europe and key fast fashion brands.

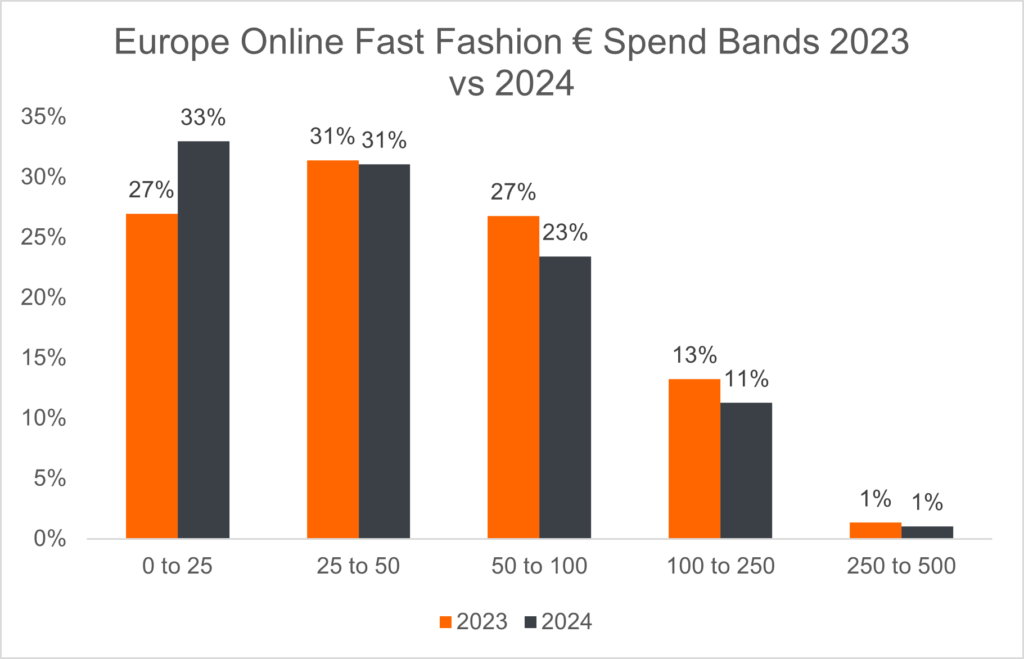

A pan-European level view

Analysis of Fable Data coverage of clothing retailers reveals that 60% of the Fast Fashion retailers’ online spend falls within the bottom two spend bands < €50 per transaction.

Share of the bottom most band €0-25 has increased from 27% in 2023 to 33% in 2024, implying that customers are downtrading or looking for bargains.

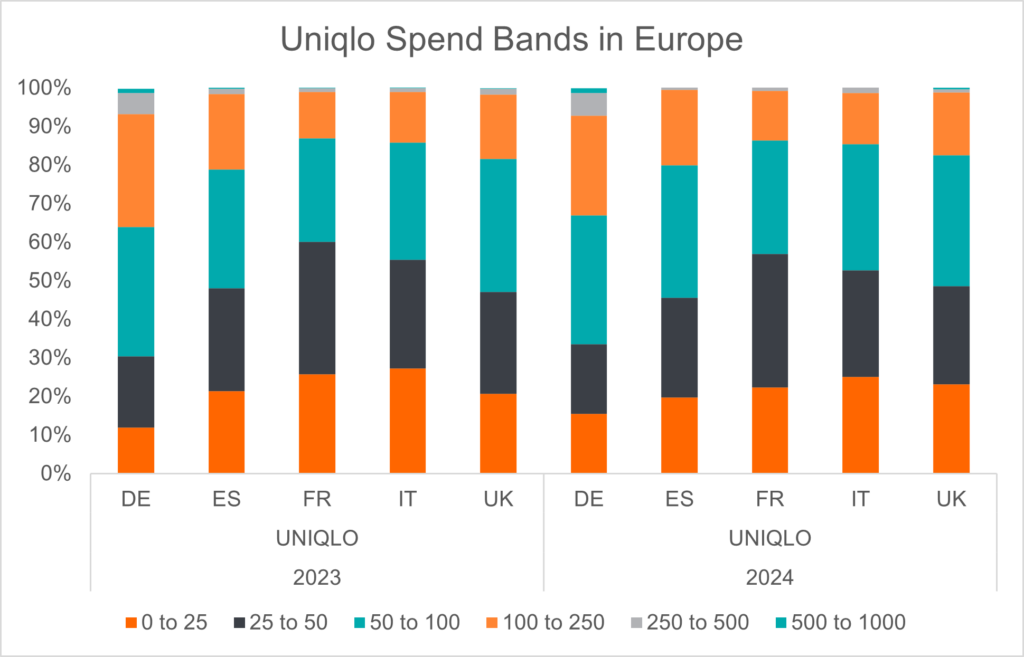

Amongst the bigger names Next, Primark and Uniqlo are the outliers having held their share in the bottom bands.

Share of spend within the €50-100 band has decreased from 27% in 2023 and to 23% in 2024, signaling increased consumer sensitivity. Again, Primark, Uniqlo and Next are the outliers who have increased or held their share in this band.

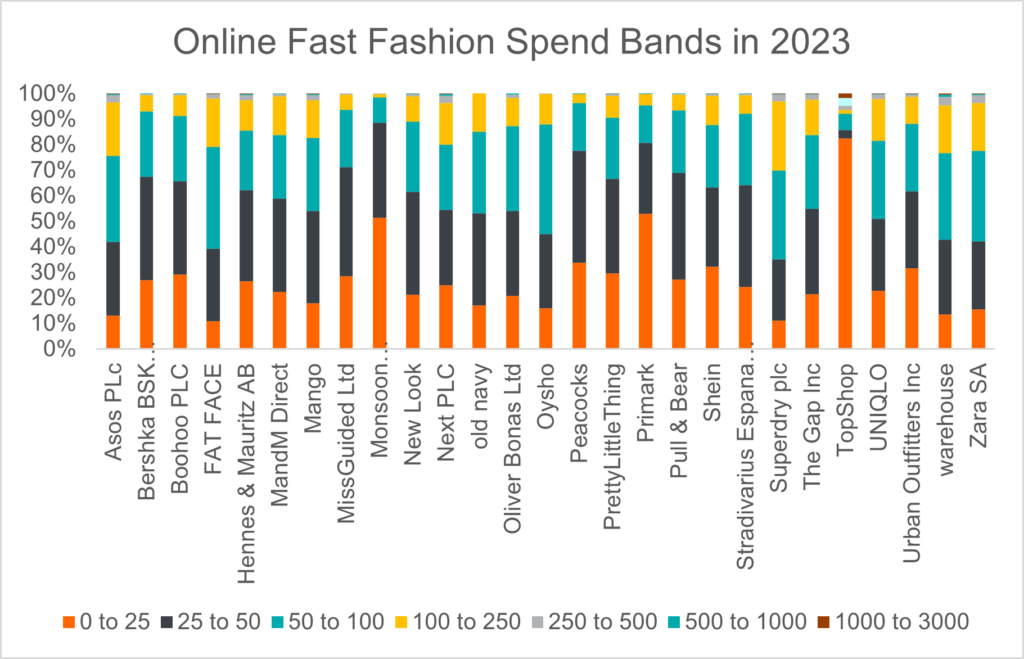

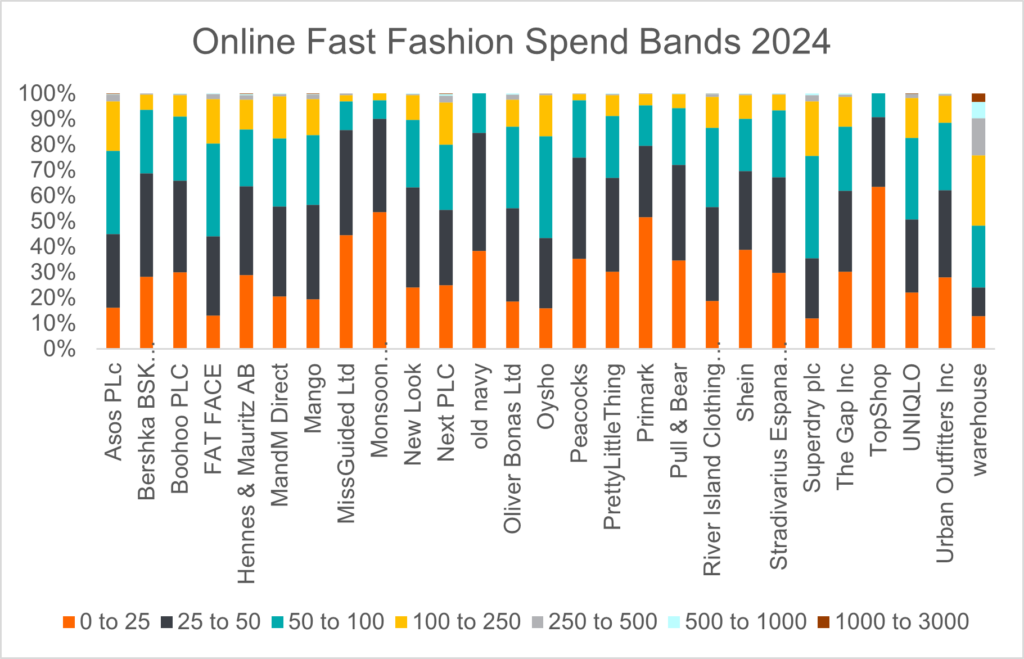

Who occupies the top spend bands and who dominates the lowest? – Categorizing brands by spend band

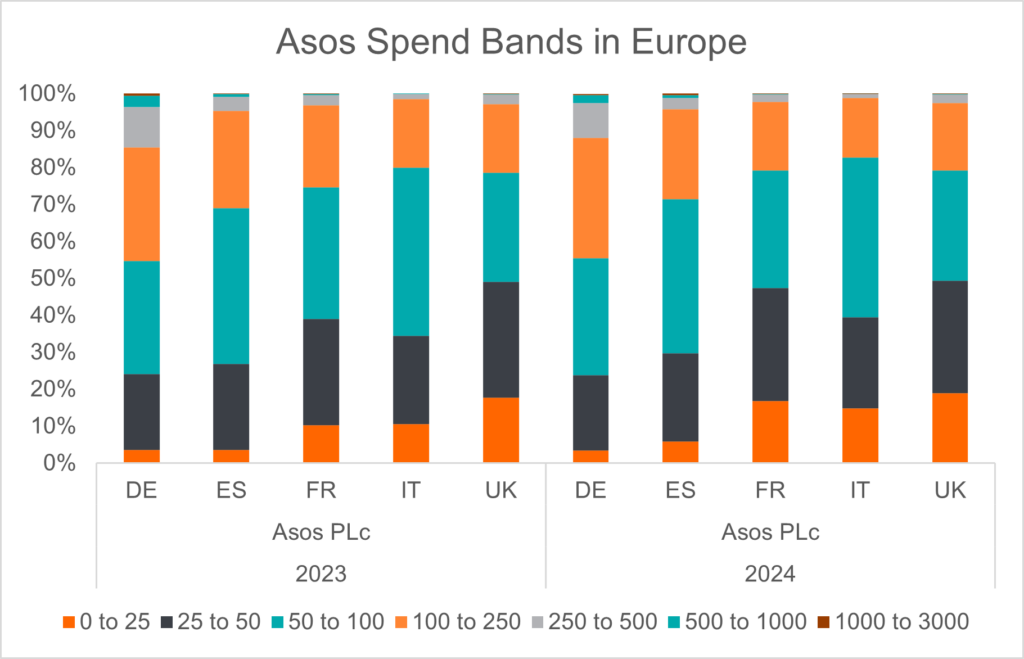

- Asos and Zara take a higher share of the top bands with 60% of spend >€50 per transaction.

- Uniqlo, Next and Mango occupy the middle ranges with 50% of spend >€50 per transaction.

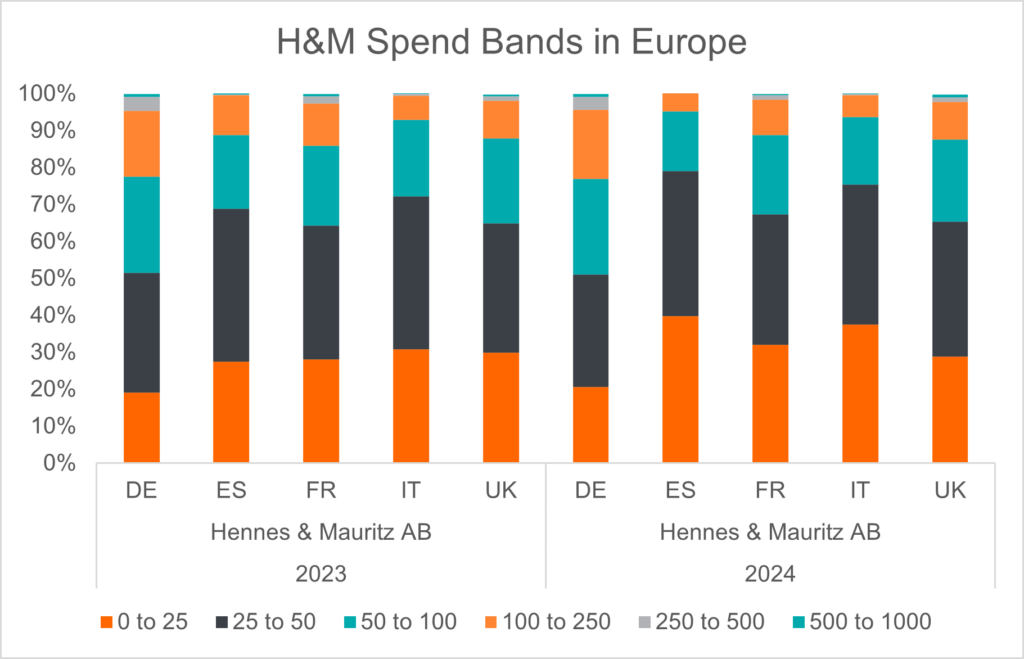

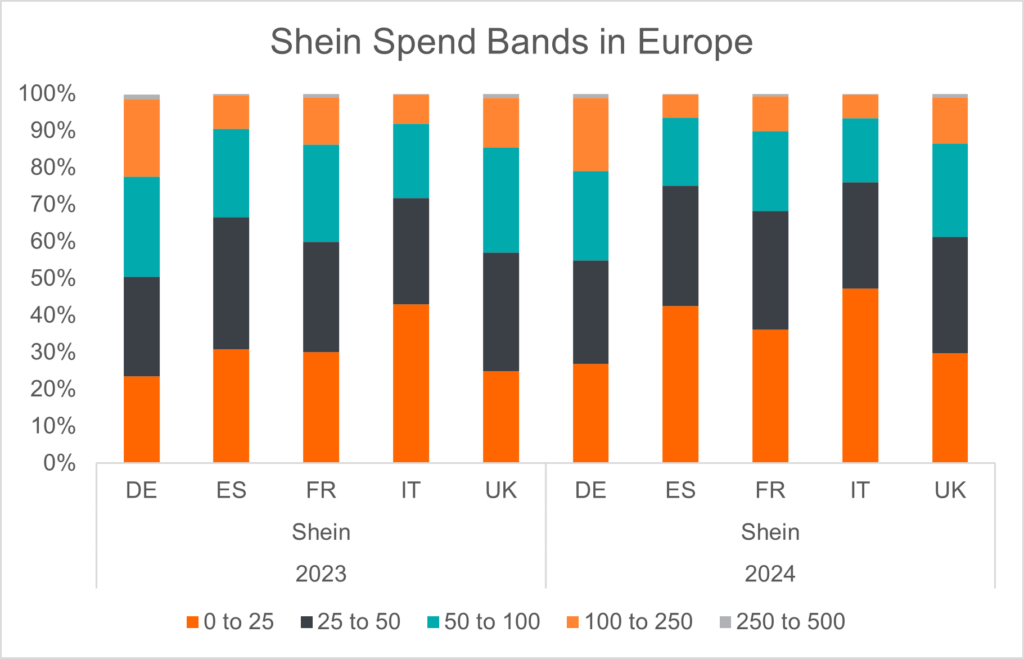

- For H&M, Boohoo and Shein 60% of transactions fall within the bottom two bands <€50.

- Primark, Monsoon and Top shop (Asos) transactions dominate the lowest spend bands with 80-90% of spend <€50 per transaction and 50% of spend <€25 per transaction.

2023:

2024:

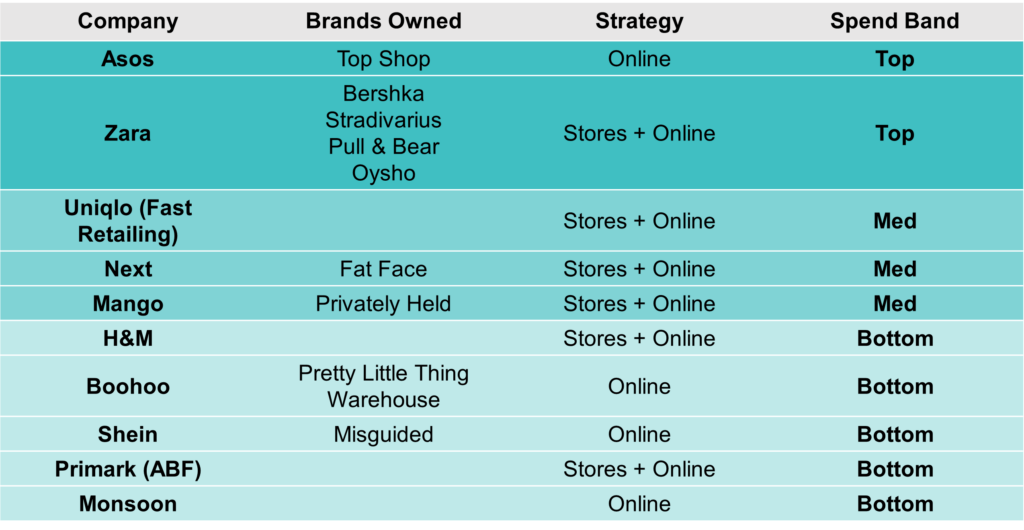

How does a brand’s portfolio strategy help it take customers at every level?

Topshop (Asos group) caters to customers with similar spend bands as those of Primark and Monsoon in 2023, however this has improved in 2024 to spending in one band higher, like H&M.

Out of Inditex – Zara brands, Bershka, Stradivarius and Pull Bear customers are within spend bands similar to those of H&M, Boohoo and Shein. Oysho brand customers spend in a similar way to those of Zara.

Customers of Fat Face (acquired by Next) spend within higher spend bands, similar to those of Asos, and fall in a higher category than overall Next brands.

Brands categorized by spend band

Geographical nuances in spend bands per brand

- Spain and UK: Zara, Next and Primark

Zara online has a lower spend band in Spain – its home country – than Rest of Europe because of the presence of physical stores and a strategy that prices higher in non-home markets. We see a similar pattern with Next and Primark with a higher portion of spend in lower bands in the UK – their home country. More recently for the first 5 months of 2024, Spain is overtaking UK in the lower two bands for Next and Primark.

Stress in Spain?

Spain has seen a greater share of spending at lower spend bands for Next and Primark (as seen above), implying discounting and/or increased competition. Boohoo’s spend bands have dropped to 100% of transactions below €50 (from 52% in 2023). Similarly, spending at the bottom two bands has increased by 10% at Shein and H&M in Spain.

Higher spend per transaction in Germany

Germany has a higher share of spend bands over €50 at 60% compared to the other European markets at 45%. Asos and Uniqlo enjoy higher spend in Germany with 70-80% of transactions over €50. Management of Asos commented “they held share in core markets Germany and France that were weak” in their latest 1Q2024 results.

Get in touch if you’d like to see the full analysis or understand more about our Pan European Consumer Transaction datasets covering the 5 major European economies.