In Review: The Impact of New Strategies on Streaming Giants

With over 100 million subscribers to the likes of Netflix and Disney+, streaming services have become the ubiquitous method for consuming media. The race started with YouTube in 2005, followed by the likes of Spotify and Amazon Prime Video in 2006, Netflix in 2007 and jumping forwards to more recent years, Disney+ and Apple TV+ in 2019 (and many more in between).

With this growth has come increased competition in the fight for market share and consumer loyalty with services pivoting their business models in a bid to remain competitive. As Spotify said last year, ‘monetization and efficiency take centre stage’.

Using Fable Data’s European consumer transaction data, we’ve analysed the impact of these changing business models looking specifically at Netflix and Spotify. Both are offering consumers more options, but at a price – and at a time when consumers are feeling the pinch – ultimately with the aim to increase revenue per subscriber. But what has this done to subscription tier and plan mix; are consumers up- or downgrading as a result? How resilient have consumers been? Has it achieved what the streaming services ultimately wanted; more monetization and revenue?

Why is Europe Important?

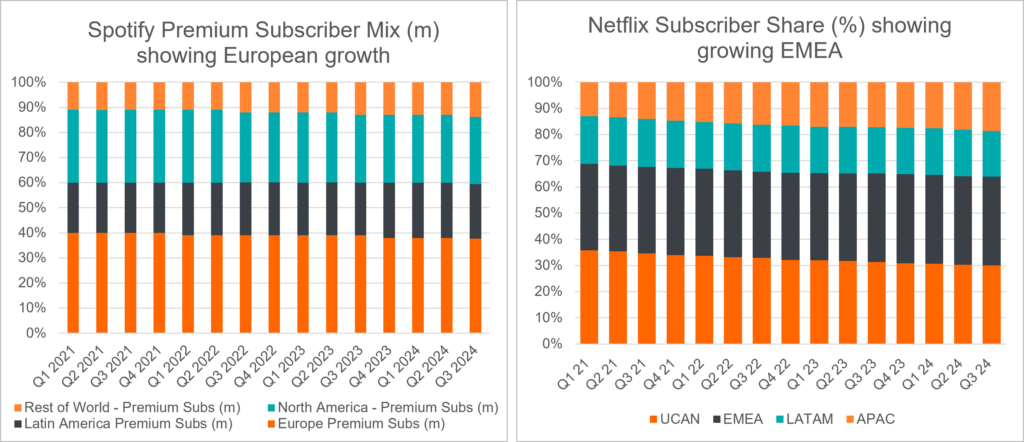

- Europe is the fastest growing region for both Spotify and Netlfix.

- Europe accounts for 38% and 34% of subscribers, respectively, up from 29% 5 years ago.

- Both have prioritized Europe for launching new features and gauging market responses; Netflix’s ad-tier offering was initially launched in 12 markets, 5 of which were in Europe; Spotify chose to roll out price rises in the UK ahead of other markets to gauge the impact on consumer demand before rolling out elsewhere.

A Tale of Two Strategies

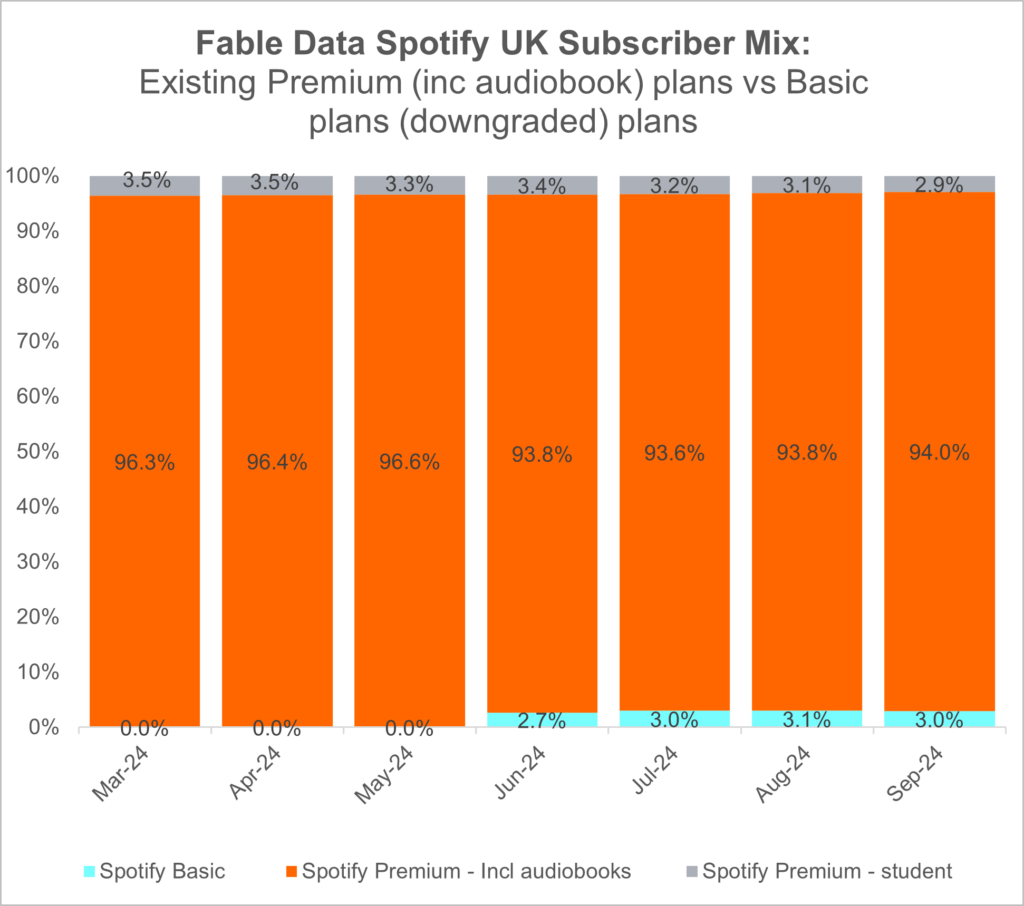

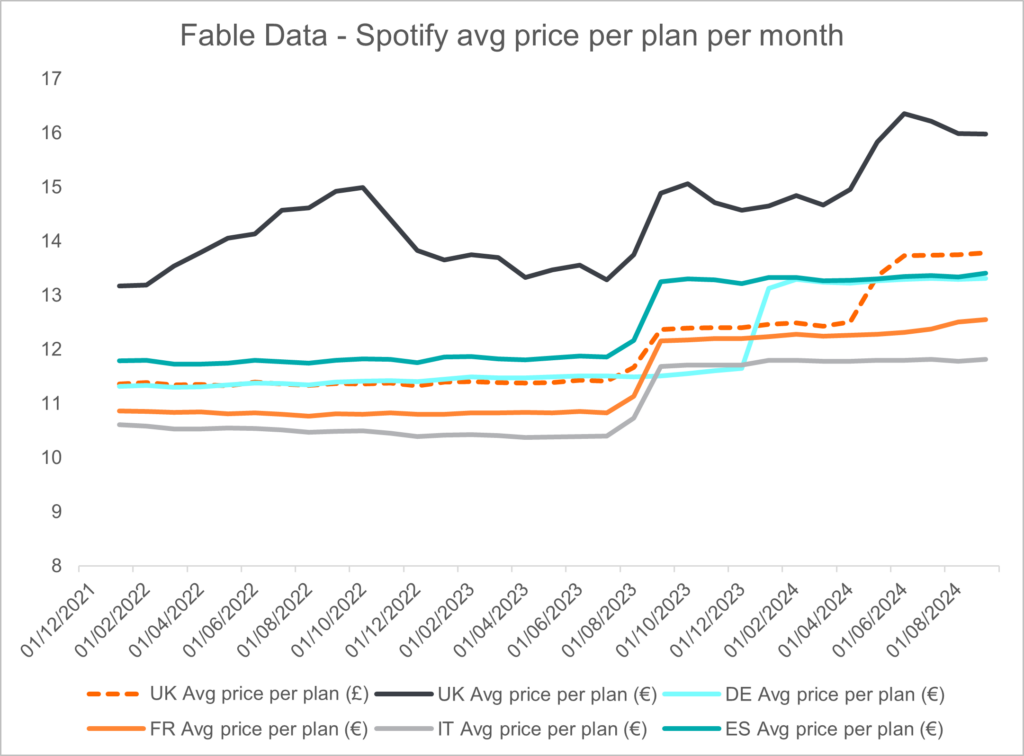

Spotify focused on monetization through price hikes and enhancing its Premium tier. In August 2023 we saw the first ever price rise introduced in the UK with other regions following. In 2024 they added audiobooks to their Premium offering and increased prices (+£1 per month), allowing subscribers to downgrade to the Basic plan (excluding audiobook) if needed.

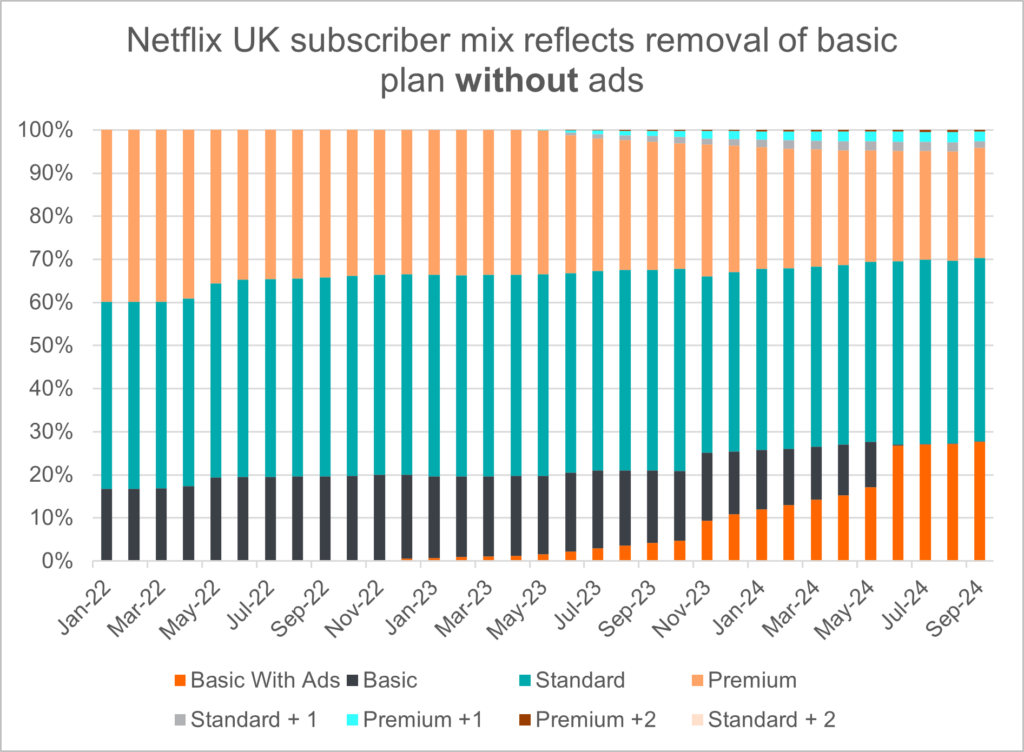

Netflix opted for a cheaper ad-supported tier while raising existing plan prices. This was only made available in 12 of Netflix’s largest subscriber markets, 5 of which are in Europe (UK, Germany, France, Italy and Spain – all covered by Fable’s data). The default was to put subscribers onto the ad tier and leave them to upgrade at will.

Despite differing strategies, both now offer similar tiered options to maximize revenue and user engagement.

Seamless for Spotify, Noticeable for Netflix

The result?

Spotify experienced a relatively seamless transition to the price rises it introduced with only a marginal shift towards the more affordable plans (Family and Duo).

Price rises didn’t deter subscribers: Only 3% UK subscribers chose to downgrade despite two price rises within 12 months.

Low to no change in plan mix: Rather than disruption, we see a continuation in trends already in play before the rises. Family plans remain the most popular at 40-60% of plans and Duo plans continue to gain subscribers in most markets at 10-20% of plans.

Price rises fueling growth: Over the last year, average monthly plan prices are up by c.13-15% across Germany, France, Italy and Spain while UK prices have risen nearly 20% following two prices rises in Aug-23 and Apr-24. This has fuelled much of the growth for Spotify in the last year.

Netflix, on the other hand, has seen a more drastic shift.

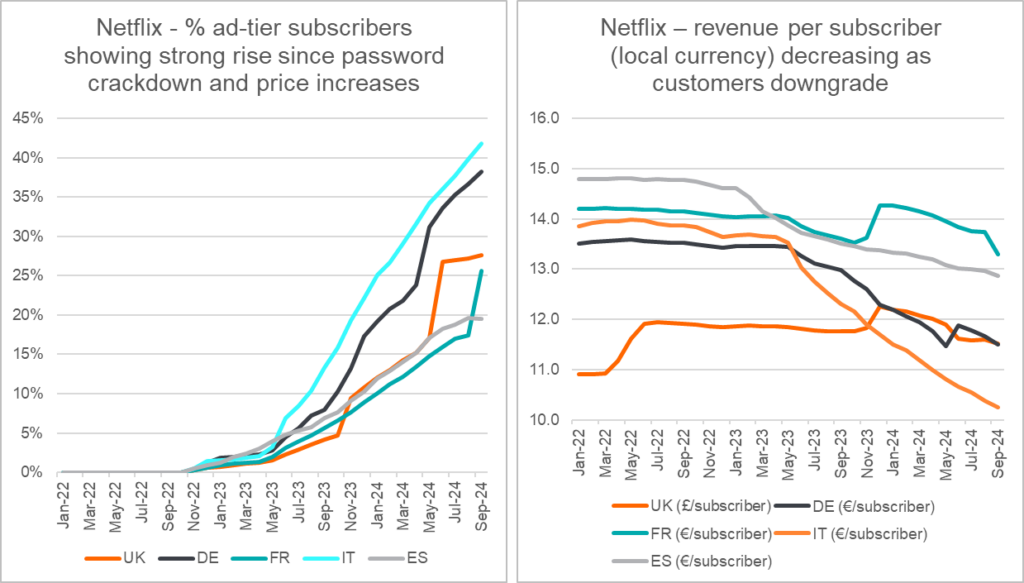

Basic ad plans growing while Premium plans in decline: Fable Data indicates strong uptake of Basic Ad plans, now representing >20% of subscribers across key European territories, while Premium plans are waning across all regions as a result, likely accelerated by increasing cost of living pressures and the crackdown on password sharing.

Decline in price per user: The strong uptake in Basic Ad plans is resulting in a steep decline in avg price per month of between (1-2 €/mth), across European countries.

Price rises to offset take-up of cheaper plans: Netflix is using price rises as an offset, seen most recently in UK, France and Germany. With new subscribers now more heavily weighted towards lower tiers, price per subscriber is likely to continue to track lower. Today this is being offset by user growth from password sharing crackdowns, although in coming years these tailwinds are likely to subside.

So, what does this all mean?

For Netflix, the quick uptake in ad-tier plans has perhaps surpassed even their own expectations. Ultimately this rapid change in strategy and strong consumer uptake will only increase Netflix’s reliance on advertising for revenue.

Spotify’s shift in business model is more subtle. 2023 and 2024 saw them pull the pricing lever on consumers for the first time following the inclusion of audiobooks and a more expansive library of podcasts in recent years. However, if Netflix is any guide, we are likely to see even more plan tiers emerge as their offering expands.

More broadly, Netflix and Spotify are just two examples of a growing trend across the streaming industry with the likes of Disney+, Amazon Prime and many others also rethinking their pricing models and offerings to consumers. In the wake of the ‘cost of living crisis’, we see consumers faced with more choice than ever (in price points and products) as services fight to retain share.

Consumer spend data gives us a window into the shifts in consumer spend in real time in reaction to these changes and the macro-economic environment.