Travel spend is back!

Higher-than-expected growth in travel spend driven by Southern Europe and hotels-focused platforms.

We started the year speculating that the era of unabated “revenge travel” may be ending after the management of Booking Holding and Airbnb tempered expectations of investors. However recent results from the likes of Delta Airlines in the US, EasyJet, Marriott Hotels and Avis Car Rentals show that investors can be surprised.

Delta Airlines in the US had very good results and US travel has been stronger on the back of solar eclipse travel (April 8th) as consumers prefer “travel experience” over luxury items. In April EasyJet commented that they expect the travel boom to continue this summer despite the conflict in the Middle East. Bookings in the northern hemisphere summer continue to build well. Marriott Hotels and Avis Car Rentals have both declared more internationally focused growth with the US normalising.

With more results expected from Expedia and Booking.com in the coming days, we’ve been comparing closely to Fable’s Q1 data.

Our analysis of travel companies both online and hotel in key European markets validates the following as seen in our data:

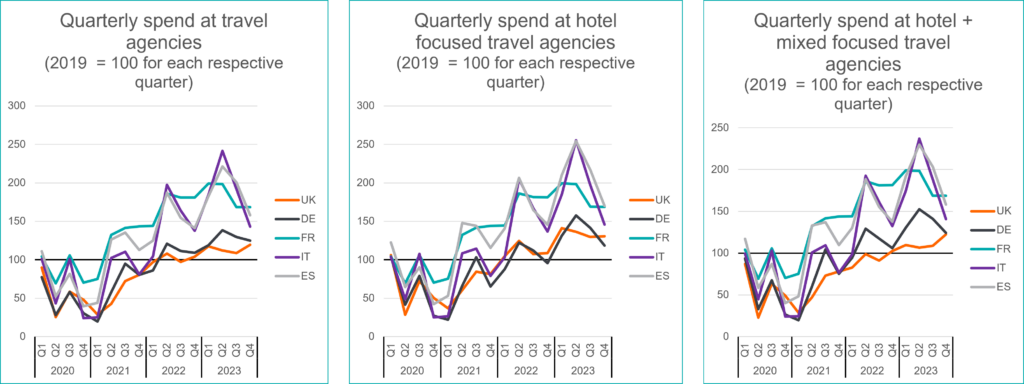

- Travel spend is back and more so in Southern Europe (Italy and France)

- Hotel focused online platforms are gaining strength

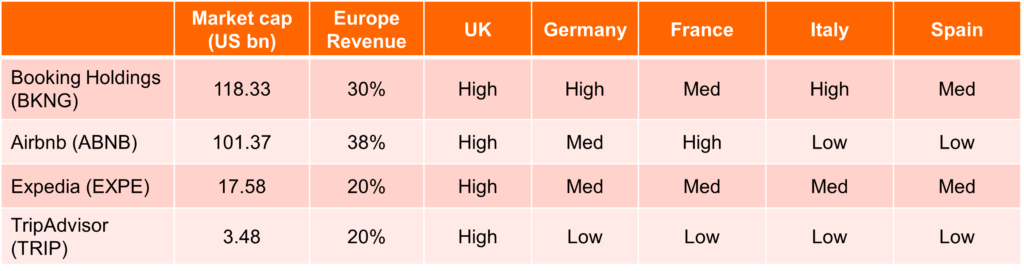

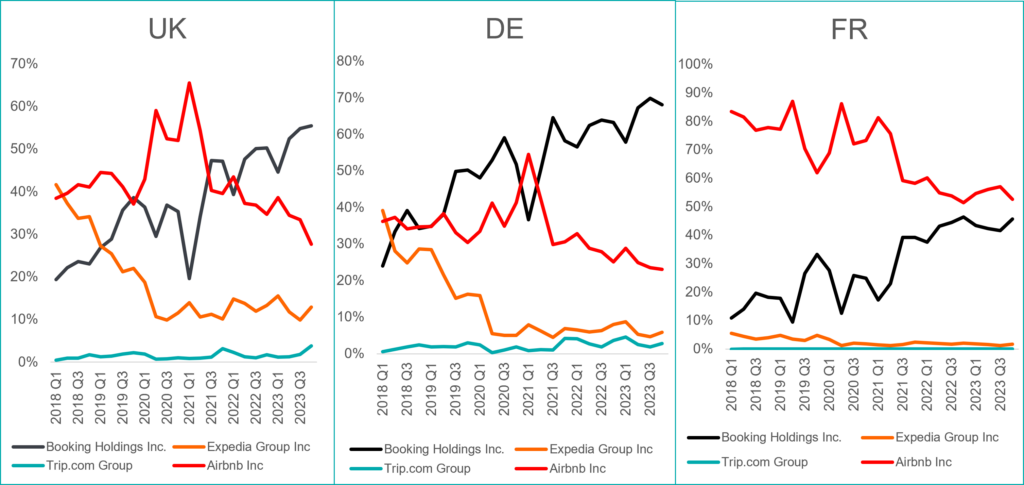

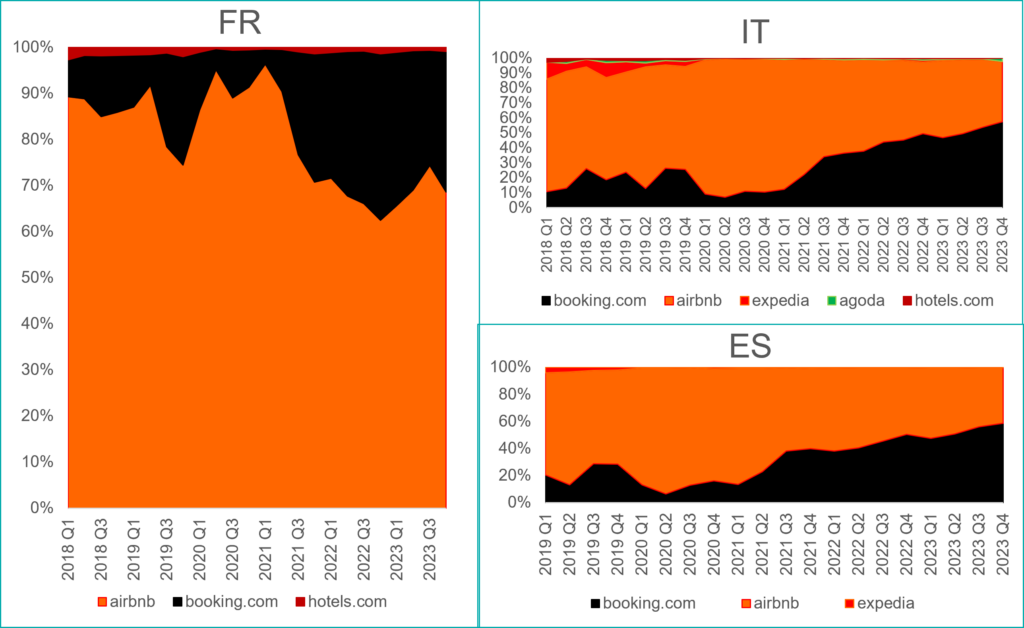

- Booking Holdings (BKNG) is growing at the expense of Airbnb (ABNB) in key European markets and in recent quarters, except France

- Expedia (EXPE) and TripAdvisor (TRIP) are showing mild growth in UK and Germany

Online paves the way

Online spend has surpassed the pre-Covid spend from 2019 with Southern European countries – Italy and Spain – showing a stronger trend.

A recent Statista report (Dec 2023) confirms that the online channel globally is 74% of revenue and 81% for Europe.

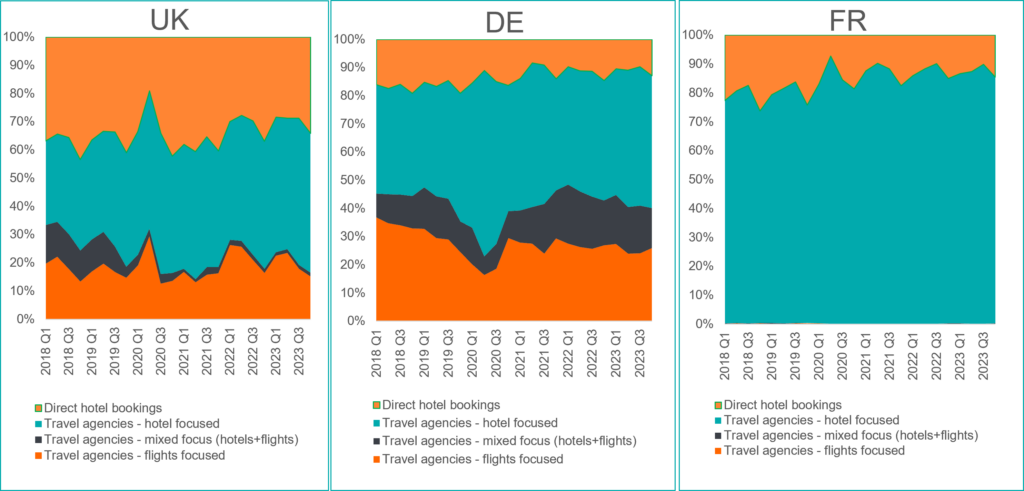

Hotels driving demand

Platforms focused on hotels command a higher share of spend compared to mixed-use travel agents/platforms. Direct spend at hotels is higher in UK with only green shoots elsewhere.

BKNG is taking the lead

BKNG is growing at the expense of ABNB (particularly in Southern markets of Italy and Spain). ABNB is maintaining its lead only in France. EXPE and TRIP show mild growth only in UK and Germany. See below analysis for UK, Germany and France.

An analysis of customers who spent at ABNB any time from 1Q2020 to 1Q2021 shows that while ABNB is still the preferred choice, a preference for BKNG is increasingly evident. See examples below for France, Italy and Spain.

With more results expected from Expedia and Booking.com in the coming days, we’ve been comparing closely to Fable’s Q1 data. Get in touch if you’d like to find out more and about our Pan European Consumer Transaction datasets.