TV and takeaways

The primary application of our data is the low latency read we give on daily sales at hundreds of merchants across Europe. We provide contextual insight as well. Through our anonymised consumer spend panel, we can discover which merchants are more likely to be shopped together.

A simple way to understand this is an analogy with a basket of products in a grocery store. We want to know which products are found with an obscure product such as anchovies. Bananas are found in a third of all baskets and are the number one associate for anchovies, that is, until we apply a correction for the relative distribution across all the baskets. After this, capers, fresh pasta and basil come out as the top three associated products.

Insight based on millions of consumer transactions are the gold standard in understanding consumer behaviour and predicting future purchases. We run this type of analysis on thousands of merchants by tagging credit, debit and banking transactions on our panel. We can see which retailers and brands are closely associated with payments to electric car charging points, Weight Watchers, Gousto meal kit subscriptions and many more.

We are also able to explore the relationship between B2B brands and cut the results by channel, for light and heavy buyers and by behavioural and demographic characteristics. We capture spend for merchants that have web presence and those that consumers struggle to recall in market research studies. Parking operators, utilities and transit fares are all tagged. Contactless, in app purchases and charitable donations have moved spend away from cash on to payment cards boosting our coverage.

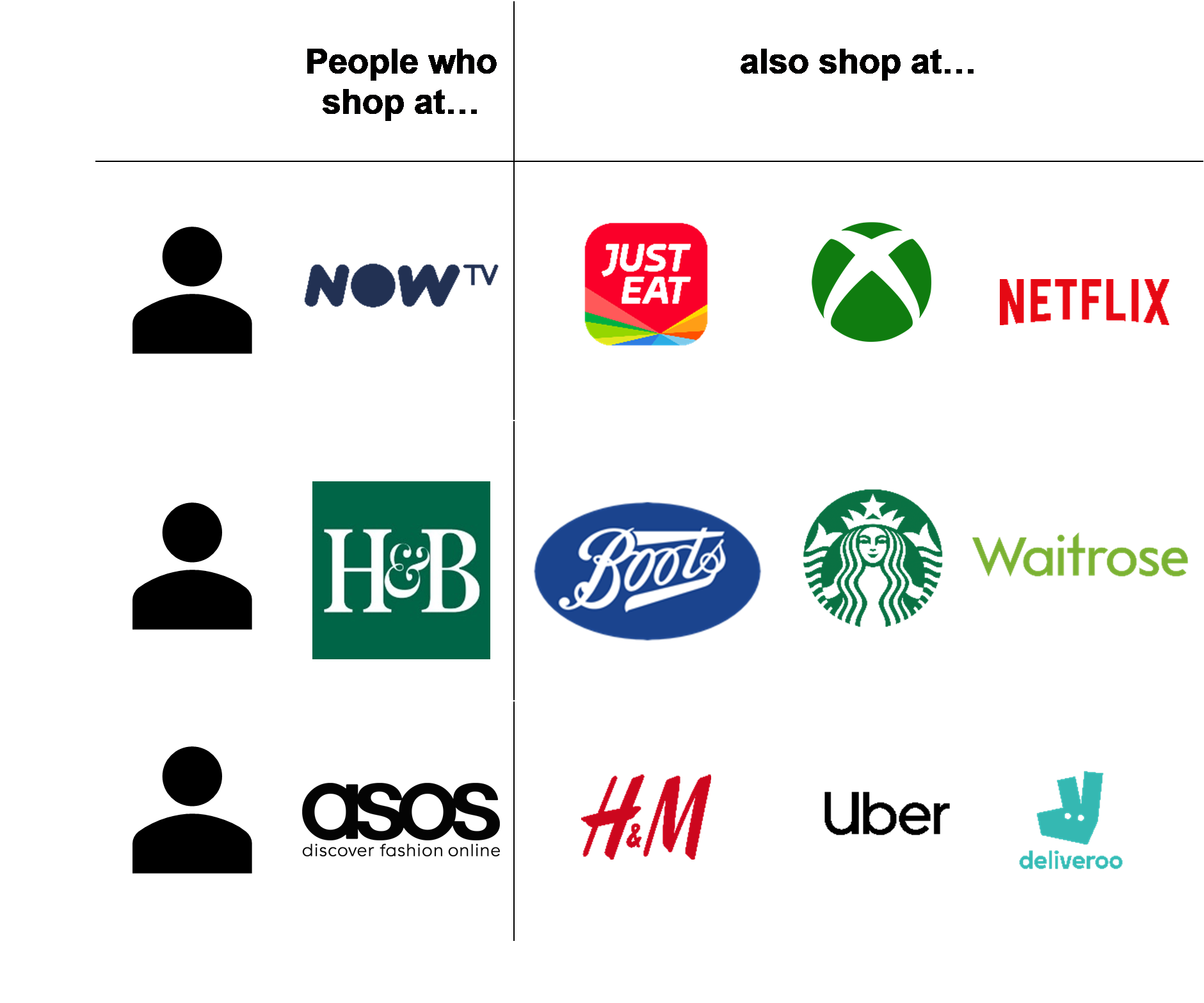

There are big overlaps on our a panel for TV licensing and Amazon Marketplace since many consumers spend with both. They are the equivalent of bananas. Half of Netflix subscribers also use Spotify. So what? When we bring in the significance filter, we see more useful insight. Online fast fashion retailer, ASOS (LSE: ASC) consumers prefer Deliveroo (privately held) and Now TV (ultimately owned by Comcast NASDAQ: CMCSA) viewers use just eat (LSE: JE) for their takeaways. Holland & Barrett consumers also spend with Waitrose, Boots and Lush. Soft furnishings retailer Dunelm competes with The Range, Matalan and Ikea.

This insight provides valuable information for our investment clients when determining a competitive set, sizing a sector of the consumer economy and making property decisions. IPOs, mergers and acquisitions can all benefit from our Data Science expertise.